Future, a Maryland startup aiming to nudge consumers toward environment-friendly choices, has raised $5.3 million in seed funding.

Boston-based Accomplice led the round, with participation from the Massachusetts unit of Techstars Ventures, Canada’s Active Impact Investments, the Netherlands’ Urban Impact Ventures, London’s Climate Capital and American activist-writer Baratunde Thurston.

The Silver Spring, Md.-based Future’s key vehicle in its climate change goals is the FutureCard Visa Card, which offers cashback rewards to consumers for low-carbon purchases. “There’s a common misconception that reducing carbon emissions in our day-to-day life is hard and expensive,” said cofounder and CEO Jean-Louis Warnholz, who was previously a policy aide to Secretary of State Hillary Clinton. “Future is on a mission to change that by connecting our members with brands, products, and services that are good for your wallet and good for the planet.”

Touched by Africa

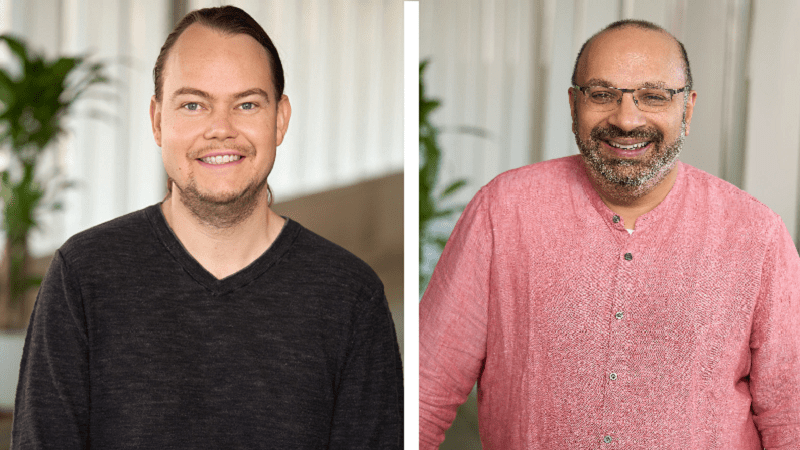

Future was founded last year by Jean-Louis Warnholz and Kamal Bhattacharya, both of whom were touched by the profound impact of climate change after working in Africa. The native German worked for the Soros fund as well as the World Bank and S&P Global Ratings, besides BlackIvy, a US firm that builds infrastructure in Ghana, Kenya and Tanzania. Bhattacharya, a native Indian, worked for Kenyan telecom carrier Safaricom, famous for its Mpesa digital currency. He has also taught at MIT.

The two believe that climate change cannot be arrested by simply planting trees. What makes better impact is consumer choices that lead to about two-thirds 66% of all carbon emissions, they say.

FutureCard Visa Card is a debit card. It is easy to acquire for users because it does not require a credit score. Future hands out 5% cash back on green purchases and 1% on others. Environment-friendly purchases not only include electric cars, vehicle charging and public transportation, but also second-hand clothes, plant-based meat and nondairy milk. The company also has developed a FutureScore app that calculates carbon footprint of consumers, allowing the really conscious among them to modify their lifestyles to reduce impact on environment.

‘Standing by Our Planet’

Accomplice was cofounded by Jack Fagnan and Ryan Moore, a former Softbank executive and current board member of sports betting firm DraftKings. It has raised $810 million from three funds, with the most recent worth $405 million in April. The firm has made over 300 portfolio investments and over 50 exits since its founding in 2015.

Commercial Real Estate

MacKenzie Companies

Law

Nemphos Braue

Financial Services / Investment Firms

Chesapeake Corporate Advisors

Commercial Real Estate

Monday Properties

Venture Capital

Blue Delta Capital Partners

Internet / Technology

Foxtrot Media

“More and more consumers across the country are looking for simple and rewarding ways to do right by our planet,” said Moore. “Future is building a new category of financial product that helps them do just that.”

Accomplice’s portfolio investments this year include Rocketplace, Gordian Software, Robin, Endstate, Nautical Commerce, Jackpot, Flexpa, Postscript, Tripscout, Gigasheet, Fetcher, Caribou, Ness, NeighborSchools, Tappp, Electives, AngelList Talent, StellarFi, Flume Health, Secureframe, Grata, Stader Labs, Appcues and Acorn Finance.

Cambridge, Mass.-based Atlas Venture was founded by Michiel de Haan in 1980. So far, it has raised $3.6 billion, including a $450 million fund in March. The firm has made nearly 600 portfolio investments, and over 150 exits. Its portfolio investments this year include Nimbus Therapeutics, AbCellera, Disc Medicine, Remix Therapeutics, Sionna Therapeutics, Be Biopharma and Arkuda Therapeutics.