BURLINGTON, Mass. & MIAMI–(BUSINESS WIRE)–Everbridge, Inc. (Nasdaq: EVBG), a global leader in critical event management and national public warning solutions, today announced that it has entered into a definitive agreement to be acquired by Thoma Bravo, a leading software investment firm, in an all-cash transaction valuing Everbridge at approximately $1.5 billion. The transaction is expected to help accelerate the Company’s continued growth at a time of rising global uncertainty and increased prioritization of public safety and operational continuity. Upon completion of the transaction, Everbridge will become a privately held company.

Under the terms of the agreement, Everbridge shareholders will receive $28.60 per share in cash. The per share purchase price represents a 32% premium to the Everbridge volume-weighted average share price over the last 90 days.

Everbridge was founded in the aftermath of 9/11 with the mission of helping to keep people safe and organizations running amid critical situations. Its suite of Software-as-a-Service (“SaaS”) products encompassing mass notification, IT incident management, travel risk management, physical security information management, population alerting, and risk intelligence, has positioned Everbridge as a trusted partner to meet the evolving needs of a diverse base of 6,500+ customers through a comprehensive and unified interface. Everbridge customers include multi-national enterprises across industries such as financial services, manufacturing, retail, transportation, energy & gas, and education, as well as national, state, and local government bodies and U.S. Federal agencies.

“Joining Thoma Bravo will mark a pivotal moment for Everbridge and our mission to empower organizations worldwide with the tools to successfully navigate critical events,” said David Wagner, President and CEO of Everbridge. “Over the last several years, we have expanded and evolved our business to support customers in an increasingly complex threat landscape. Thoma Bravo’s comprehensive experience in the risk, compliance, and safety sectors and commitment to fostering innovation will enable us to better help our customers keep people safe and their organizations running. This agreement is a testament to all we’ve achieved together as one Everbridge and represents the beginning of an exciting new chapter for our team, our partners, and our customers.”

“We are pleased to deliver immediate, compelling, and certain value to our shareholders through this transaction,” said David Henshall, Chairman and Lead Independent Director of the Everbridge Board of Directors. “Over the past several years, the Everbridge Board has consistently reviewed the Company’s stand-alone opportunity against other strategic opportunities, including dialogue with a range of potential partners. This agreement is the result of those efforts and reflects our commitment to maximizing value and certainty on behalf of our shareholders.”

“We look forward to working with Everbridge to expand their ability to capitalize on opportunities in an expanding marketplace for risk, compliance, and safety solutions,” said Hudson Smith, Partner at Thoma Bravo. “The Everbridge product portfolio is already used by some of the world’s most-respected corporations and organizations to comprehensively monitor risk and manage critical events, and we see an extensive runway ahead for product innovation and profitable growth.”

“We’re thrilled to partner with the Everbridge team to keep building on the strong business they’ve created in critical event management,” said Matt LoSardo, Principal at Thoma Bravo. “Our shared vision, coupled with Thoma Bravo’s software and operational competencies, will support Everbridge to accelerate its growth initiatives and better serve its customers during this exciting next chapter for the company.”

Transaction Details

The transaction, which was approved by the Everbridge Board of Directors, is expected to close in the second calendar quarter of 2024, subject to customary closing conditions, including approval by Everbridge shareholders and the receipt of required regulatory approvals. The transaction is not subject to a financing condition.

The agreement includes a 25-day “go-shop” period expiring on February 29, 2024, which permits the Everbridge Board and its advisors to actively initiate and solicit alternative acquisition proposals from certain third parties, as described in the merger agreement. The Everbridge Board has the right to terminate the merger agreement to accept a superior proposal subject to the terms and conditions of the merger agreement. There can be no assurance that this “go-shop” will result in a superior proposal, and Everbridge does not intend to disclose developments with respect to the solicitation process unless and until it determines such disclosure is appropriate or otherwise required.

Upon completion of the transaction, Everbridge common stock will no longer be listed on any public stock exchange. The Company will continue to operate under the Everbridge name and brand.

Advisors

Qatalyst Partners is serving as financial advisor and Cooley LLP is serving as legal counsel to Everbridge. Kirkland & Ellis LLP is serving as legal counsel to Thoma Bravo.

About Everbridge

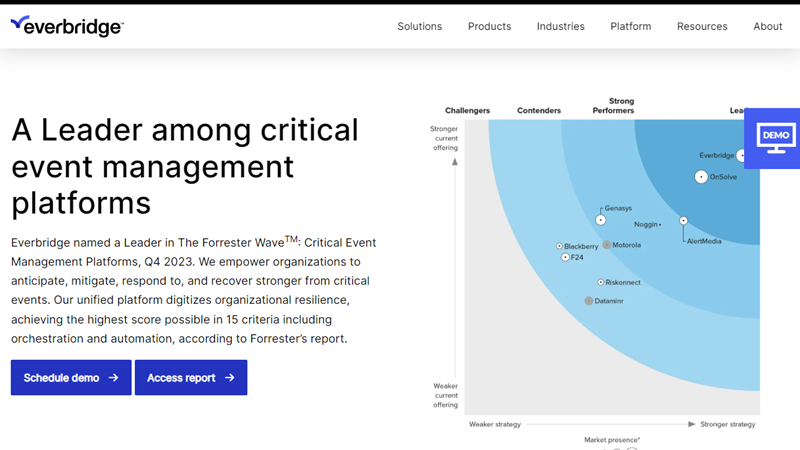

Everbridge (Nasdaq: EVBG) empowers enterprises and government organizations to anticipate, mitigate, respond to, and recover stronger from critical events. In today’s unpredictable world, resilient organizations minimize impact to people and operations, absorb stress, and return to productivity faster when deploying critical event management technology. Everbridge digitizes organizational resilience by combining intelligent automation with the industry’s most comprehensive risk data to Keep People Safe and Organizations Running™. For more information, visit https://www.everbridge.com/, read the company blog, and follow on LinkedIn. Everbridge… Empowering Resilience.

About Thoma Bravo

Thoma Bravo is one of the largest software investors in the world, with approximately US$134 billion in assets under management as of September 30, 2023. Through its private equity, growth equity and credit strategies, the firm invests in growth-oriented, innovative companies operating in the software and technology sectors. Leveraging Thoma Bravo’s deep sector knowledge and strategic and operational expertise, the firm collaborates with its portfolio companies to implement operating best practices and drive growth initiatives. Over the past 20 years, the firm has acquired or invested in more than 455 companies representing over US$255 billion in enterprise value (including control and non-control investments). The firm has offices in Chicago, London, Miami, New York and San Francisco. For more information, visit Thoma Bravo’s website at www.thomabravo.com.