Summary

- The weaknesses in Apple’s Q4 2020 earnings report are most likely longer-lasting than the strengths.

- The next earnings report will be much more influential in driving stock price.

- Right now, the downside risk of being long AAPL outweighs the upside reward.

- Looking for a portfolio of ideas like this one? Members of Exposing Earnings get exclusive access to our model portfolio. Get started today »

Reading through some people’s reactions to the Apple (AAPL) Q4 2020 results, I see quite a bit of confusion. While Apple beat on revenue and EPS, many are still calling the results a “disappointment.” There is truth to this statement, but we have to dig deeper than the surface level financial numbers to see it.

Overpriced Relative to Tech

First, let us note that Apple is highly overpriced relative to both the market and its sector. Apple’s price-to-earnings ratio is double that of tech:

(Source: Simply Wall St)

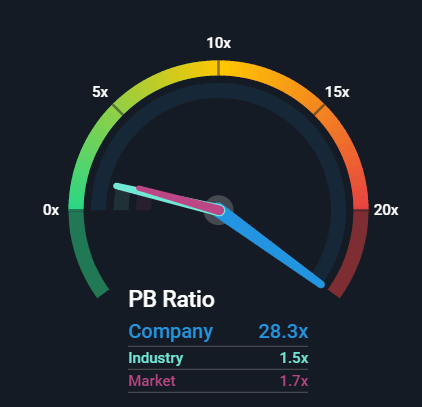

And its price-to-book is an astounding 20x the industry average: