Summary

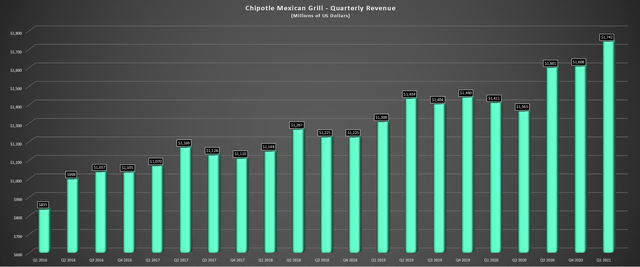

- Chipotle released its Q1 results in late April, reporting revenue of ~$1.74 billion, up 23% year-over-year and 33% from Q1 2019 levels.

- The continued strength relative to peers can be attributed to the company’s brand strength and strong digital footprint, with over 50% of sales coming through digital channels.

- While Chipotle seems set for solid earnings growth ahead as it targets higher restaurant-level margins and high single-digit unit growth, the stock continues to look fully valued in the short term.

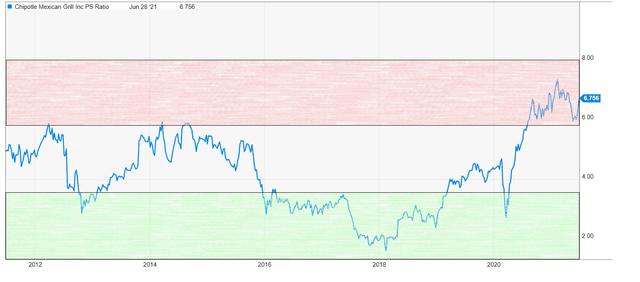

- At a valuation of nearly 6x forward price to sales, I would view any rallies to new highs above $1,600 as an opportunity to book some profits.

We’ve seen an incredible rally for the restaurant stocks since last summer, with the group up 28% since the end of Q2 2020, slightly outperforming the S&P-500. However, one of the weaker performers in the group as of late has been Chipotle , with the stock easily outperforming the S&P-500 and other restaurant stocks last year but lagging them the past three quarters. With Chipotle being one of the most impressive growth stories in the industry, growth is not the issue. So, while Chipotle is arguably one of the best buy-the-dip candidates for long-term investors, I don’t see enough margin of safety to justify buying here above $1,515.

(Source: Company Website)

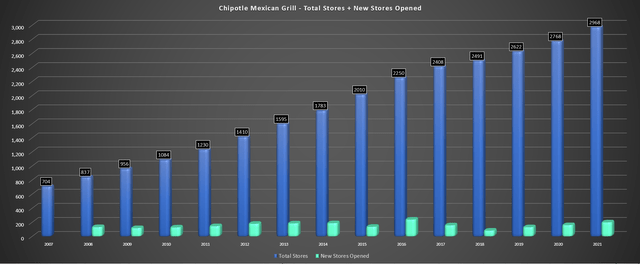

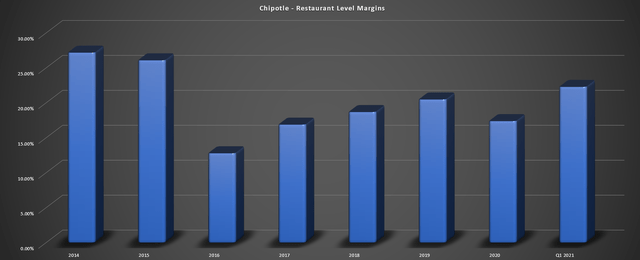

Chipotle released its Q1 results in late April and reported another impressive quarter with revenue of ~$1.74 billion, 17% comparable sales growth, and restaurant-level margins of 22.3%. The sales figured translated to 23% growth year-over-year and the strongest growth rate in the past 18 months, with revenue climbing an even more impressive 33% on a pre-COVID-19 basis vs. Q1 2019. Chipotle noted that it opened 40 new restaurants in the quarter and now has just over 2,800 restaurants, and the company is confident that it can double its restaurant base to 6,000 long-term. Let’s take a look at the quarter below:

It was a busy quarter for Chipotle with the launch of cauliflower rice and quesadillas, a digital-only offering, with strength in both helping to drive strong sales growth in the period. While the company is not continuing with cauliflower rice, quesadillas will stay on the menu and are a powerful tool to grow digital sales. Given their digital-only designation, the offering should bring some regular walk-in customers onto the company’s platform to try it out and also bring new customers to Chipotle, which could translate to repeat visits down the road. So far, the strategy looks to be paying off, with digital up 134% year-over-year and lapping 81% growth in Q1 2020.

(Source: 1851Franchise.com)

As it stands, Chipotle has a massive lead on most of its competitors, with digital coming in at 50.1% of sales. However, it’s important to note that Chipotle is achieving this growth without the benefit of fully re-opening dining rooms. The company noted that all restaurants except 20 are now open, and 92% offer in-store dining, but with capacity limitations. Once restrictions are fully lifted, we should see a boost for Chipotle demand with a slight increase in sales for those preferring to eat on-premise. In addition, we should see a minor tailwind with increased beverage sales, with beverages carrying higher margins.

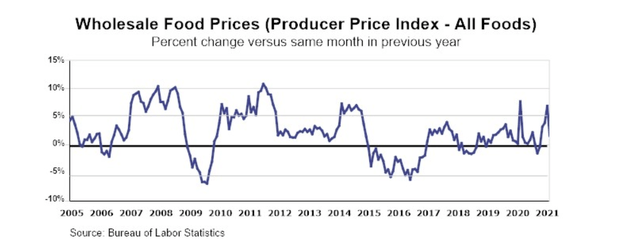

Overall, food costs in the quarter came in quite low at 30% and dipped by 280 basis points. This was related to a mix shift towards higher-margin proteins and menu price increases. However, food costs as a percentage of sales are expected to increase in Q2. The company has a slight headwind from seasonally higher-priced avocadoes, partially offset by a menu price increase for delivery. So far, the strategy to increase delivery costs has paid off, with less of a margin impact due to the menu price increases and some customers migrating to picking up at Chipotlanes vs. third-party. Based on wholesale food price data, we could see some food cost inflation, with wholesale food prices on track to post their largest annual increase since 2014, led by beef and fresh vegetables. Fortunately, for Chipotle, its offerings also include poultry and pork, where price increases have been nowhere near as dramatic to date.

(Source: Restaurant.org, Bureau of Labor Statistics)

Chipotle ended the quarter just shy of 2,800 restaurants, with 65% of the 40 new restaurants opened in the quarter having Chipotlanes. The goal for 2021 is high single-digit unit growth with a target of 200 new restaurants this year, with plans for a minor step-up in Chipotlanes relative to the percentage of newly opened restaurants (70%). We relate this push for Chipotlanes at new restaurants to the outperformance for stores with Chipotlanes, with the company noting that they see 15% higher sales and better comps at these locations.

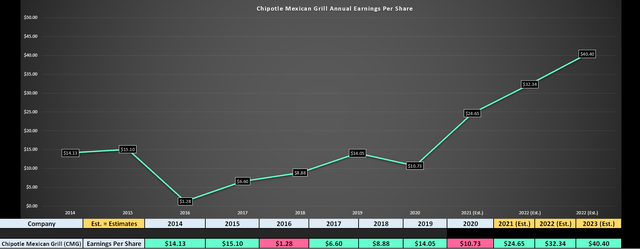

(Source: Company Filings, Author’s Chart)

Single-digit unit growth implied by guidance is on the lower end of the company’s unit growth pre-COVID-19, with the compound annual unit growth rate set to dip to ~5.7% (2016 to 2021) vs. ~12.8% (2011-2016). However, the potential remains enormous in the bigger picture even if we are seeing much lower growth rates, with plans to expand further into Canada and ultimately move towards 6,000 restaurants in total, helped by continued growth domestically. With a long-term target of 6,000 restaurants, $2.5 million average unit volumes, and 25% restaurant-level margins, it’s hard to find a more consistent growth story in the industry. Let’s take a look at the financial results:

(Source: Company Filings, Author’s Chart)

As shown above, Chipotle has continued to report steady revenue growth, with a two-year average revenue growth rate of 15.5%. This a healthy acceleration from 11% at the same time last year, and FY2021 sales are forecasted to increase by more than 20% year-over-year to ~$7.33 billion, up from ~$6.0 billion last year. Meanwhile, restaurant-level margins are trending in the right direction, heading back towards pre-outbreak issues several years ago. While I would be surprised to see restaurant-level margins come in above 23% in FY2021, it’s possible we could see a new multi-year high this year above 20.50% in FY2019.

(Source: Company Filings, Author’s Chart)

Given the margin expansion and healthy revenue growth, it’s no surprise that Chipotle has one of the most impressive earnings trends in the sector, with FY2021 annual EPS expected to increase by more than 120% in FY2021 ($24.65 vs. $10.73). While this figure is higher due to being up against an easy yearly comp due to COVID-19, Chipotle still boasts an ~8.3% compound annual EPS growth from 2014, and this figure is expected to accelerate to ~12.4% based on FY2023 estimates of $40.40. Outside of Wingstop (NASDAQ:WING), few names in this industry compete with these growth figures.

(Source: YCharts.com, Author’s Chart)

So, why not pay up for the stock if Chipotle is on track to grow annual EPS by more than 60% between FY2021 and FY2023?

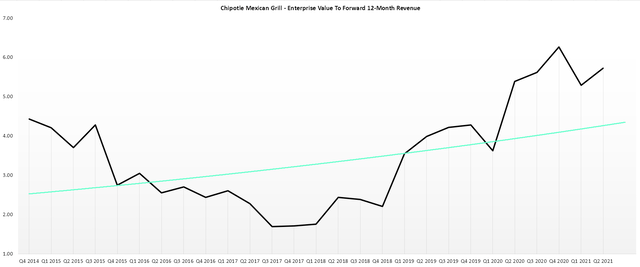

(Source: Author’s Chart)

While Chipotle is undoubtedly an exceptional growth story, the stock is now valued at more than 60x FY2021 earnings estimates and nearly 5.8x enterprise value to forward sales. In the past, it’s rarely paid off to purchase the stock at these levels, with the stock being much more prone to sharp corrections when it trades above 5.5x enterprise value to sales. Based on a current enterprise value of ~$42.5 billion and ~$7.33 billion in estimated FY2021 sales, the valuation remains unattractive at current levels, with the stock having a tough time maintaining a valuation above 6x sales in the past, even with higher restaurant-level margins (shown below).

(Source: YCharts.com)

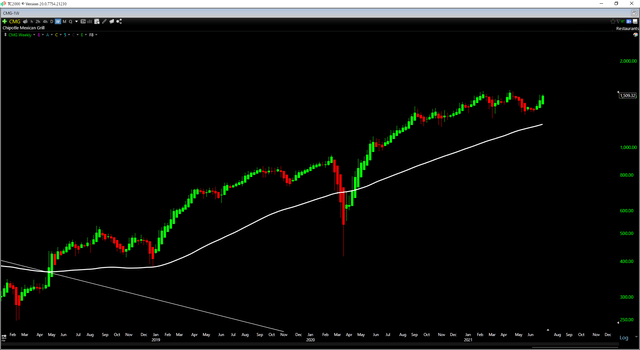

From a technical standpoint, the best time to buy Chipotle has been when the valuation has been as close to the green zone as possible for valuation (below 4.5x sales) and on dips to its long-term moving average (white line). Currently, Chipotle is nowhere near this moving average which comes in closer to $1,180, and is nowhere near its valuation buy zone, and is, in fact, trading at the top end of its historical price to sales range. This doesn’t mean that the stock has to correct sharply or that it can’t go higher, but it does suggest that investors buying here are not getting much of a margin of safety.

(Source: TC2000.com)

Chipotle has a strong year ahead and continues to innovate, and its ability to lead most of its peers in digital growth suggests a bright future ahead. However, at nearly 6x forward sales, I don’t see any margin of safety here for starting new positions. This is especially true when we consider that we see some signs of elevated complacency levels in the overall market, which could also be susceptible to a correction from current levels.