- Alphabet, along with most big tech companies, is under scrutiny by U.S. regulators for monopoly powers.

- A breakup could unlock value at YouTube, Google Cloud, and Waymo.

- The stock remains the cheapest amongst the tech giants, trading at only 17x my non-GAAP ’21 numbers.

- Looking for a helping hand in the market? Members of Out Fox The Street get exclusive ideas and guidance to navigate any climate. Get started today »

With the U.S. government on the warpath to break up big tech, investors need to start preparing for the eventual possibility. Alphabet (GOOG, GOOGL) sits as the favorite stock to benefit from a split-up. Not only is the stock the cheapest in the big tech universe looking at non-GAAP numbers, but also the company has valuable parts ignored by the market due to the dominance of Google Search. My investment thesis remains even more bullish on the stock on a breakup despite a period of likely higher legal expenses.

Breakup Potential

The House Judiciary Committee released a report suggesting “monopoly power” at four of the biggest U.S. tech firms. Besides Alphabet, Amazon (AMZN), Apple (NASDAQ:AAPL), and Facebook (FB) are the targets of the Feds while Microsoft (MSFT) has so far set out any regulatory questions.

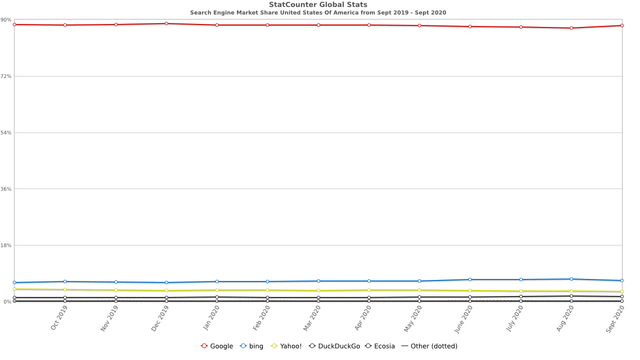

The DOJ and state regulators apparently are on the verge of pursuing a legal case to force Alphabet to unload their dominant Chrome browser that is used to funnel traffic to the Google search engine. According to the Feds, the end result is a dominant position in the large digital ad market via a near 90% dominance in the U.S. search engine market share.

Source: Statcounter

Source: Statcounter

Despite the extreme value inherent in search engine revenues, nobody, including Microsoft and Yahoo, has been able to challenge the dominance of Google search. The data doesn’t exactly support that consumers wouldn’t still use Google Search, if the Chrome web browser was owned by an independent company.