Despite inflationary concerns delaying anticipated cuts in interest rates, IPA Capital Markets, a division of Marcus & Millichap (NYSE: MMI), specializing in capital markets services for major private and institutional clients, reports a general sense of optimism flooding the markets.

It was only a few months ago that, following its December meeting, the Fed had effectively declared an end to its most aggressive rate hiking cycle in more than four decades by signaling three rate cuts were on the horizon in 2024, noted Brian Eisendrath, executive managing director of IPA Capital Markets.

The Fed’s message subsequently sent markets into a frenzy – in a good way: the bond market rallied dramatically with 5- and 10-year yields settling in the 3.75% range, the Dow Jones and S&P 500 hit record highs, and markets began pricing in six rate cuts in 2024 – twice the amount indicated by the Fed’s Dot Plot.

“The overwhelmingly positive sentiment was certainly welcomed after a dismal 18-month period; however, needless to say, the markets got ahead of themselves,” said Mr. Eisendrath. “To start 2024, market odds of a March rate cut were hovering in the 80% to 90% range on any given day. Fast forward to today – we didn’t see a cut in March, and we likely won’t see one in May or June, which means July is the probable best-case scenario.”

According to IPA Capital Markets we are, yet again, in a period marked by high uncertainty and volatility, which is being fueled by renewed concerns regarding inflation and the resilient economy. “The market knows rate cuts are coming eventually, but investors can’t just wait around for that time to come before making moves. And, honestly, they shouldn’t,” added Tyler Johnson, managing director, with IPA Capital Markets. “Our team is always of the mindset that volatility creates phenomenal opportunities, and the present is no exception to that rule.”

IPA Capital Markets reports that newly constructed assets coming out lease-up are frequently trading below replacement cost and stabilized assets are trading in the high-5% to low-6% cap range in most markets, among many other trends. However, you look at it, pricing is down more than 30% from the peak, so IPA believes that buyers in these uncertain times will be rewarded.

As one of the most active multifamily capital markets teams in the country, IPA Capital Markets can confidently say that there is no shortage of debt capital available to help deals get done during this challenging environment. Below is an update of how we’re seeing the various capital sources differentiate themselves and close deals to start the year.

Agencies

- Attractive lease-up and near-stab programs are helping the agencies differentiate themselves and win most financings secured by newly constructed assets trading below replacement cost. These programs are largely available for either repeat or “select” sponsors so long as stabilization can be supported within 4 to 6 months. This means that occupancy should be at or near the 80% level at closing.

- The agencies are capturing most of the market share as fixed rate spreads continue to improve, with most pricing shaking out in the mid-100’s range without factoring in rate buy downs.

- Interest rate buydowns remain popular with the ability to reduce spreads by 29-38 basis points on 5-year deals, 26-34 basis points on 7-year deals and 25-26 basis points on 10-year deals. Borrowers benefit by being able to increase proceeds well in excess of the buydown amount as a result of sizing loan proceeds to the lower all-in rate.

- Flexible prepayment structure pricing has come off ~25-30 basis points of its peak. The adders are fluctuating regularly, but flexible prepayment options are attractive once again now that the adders are back in-line with early 2023 levels.

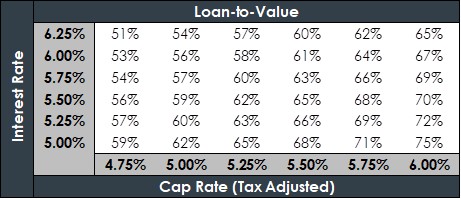

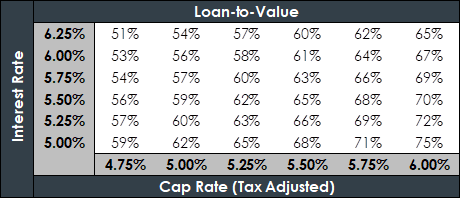

- As cap rates continue to expand throughout the country, below is a chart that shows the leverage ability at various interest rate and cap rate levels:

Life Insurance Companies

- Similar to the agencies, life insurance companies are attractively quoting newly constructed assets coming out of lease-up and creatively underwriting stabilized projections.

- The more aggressive insurance buckets have also been creative in underwriting stabilized projections for assets seeing material loss-to-lease or bad debt due to localized market conditions (i.e., political risk).

- Outside of lease-up deals, life insurance companies are still aggressively quoting stabilized newer vintage, well-located assets. Spreads have dropped with pricing ranging between the mid-to-high 100’s range.

- Flexible prepayment structures and rate buydowns have not historically been widely available; however, life insurance companies are now offering more creative structures. This is more than likely a result of fresh allocations to start the year, so these are less likely to be available towards the tail end of the year.

Debt Funds

- Debt funds are differentiating themselves by offering higher leverage (up to 70% LTC) and flexible prepayment structures. Debt funds are also comfortable with more secondary/tertiary locations and/or less experienced sponsors.

- Debt fund pricing has come in substantially, as many debt funds are over-funded and eager to put out money. For well-located, newer vintage assets, we are seeing pricing in the high-200’s to 300 range over SOFR, with lenders essentially floored at those levels.

- Debt funds are mostly winning “heavy lift” value add deals, which require significant capital improvements to execute the sponsor’s business plan. Pricing for this deal profile ranges between the low-to-high 300’s level over SOFR, which is heavily sponsor dependent.

- In the lease-up space, debt funds have been competing on deals that aren’t “ready for primetime” (i.e., lower than 70% occupancy at closing), as these types of deals won’t qualify for agency lease-up or life insurance company financing.

Banks

- Banks remain the weakest segment of the capital markets, as they are still trying to reduce their commercial real estate exposure, while largely focusing on existing relationships.

- While there are a handful of exceptions, banks are limited in starting new, non-depository, non-recourse borrower relationships. Minimum depository relationships typically start at 10% of the loan amount.

“Overall, the capital markets outlook for the remainder of 2024 and beyond looks positive, ending one of the most aggressive rate hike environments in recent history, and providing new optimism for dealmakers after a volatile 18-month period,” concluded Mr. Eisendrath.

About IPA Capital Markets

IPA Capital Markets is a division of Marcus & Millichap (NYSE: MMI). IPA Capital Markets provides major private and institutional clients with commercial real estate capital markets financing solutions, including debt, mezzanine financing, preferred and joint venture equity, and sponsor equity. For more information, please visit institutionalpropertyadvisors.com/capital-markets