Summary

- The current economic environment has created a “perfect storm” for lumber as production declines and demand skyrockets.

- Lumber prices will likely peak soon as construction contractors finally acquire materials to meet summer contract needs.

- High potential foreclosures next year and the recent drop in pending home sales may indicate a glut in housing inventory which could upend the spike in lumber demand.

- Weyerhaeuser appears overvalued based on long-term earnings estimates, but its “inflation hedge” potential partially offsets this risk.

One of the most significant impacts of the “COVID crisis” has been a drop in production and a general increase in demand. Production of many raw commodities has declined and has been further limited by a strained global shipping shortage. However, demand has remained strong due to immense deficit spending in the U.S and, to a lesser extent, other developed countries.

Basic economics teaches us that when demand rises and supply declines, prices rise or shortages are created. This has been particularly true in the lumber market as the price of lumber is currently around 4X its long-term average. See below:

Clearly, something that was holding the lumber market down snapped over the past year and caused prices to skyrocket. In fact, there is more than one reason for the substantial increase. First, COVID has led to a general decline in production from many mills. To make matters worse, milling companies like Resolute Forest Partners have struggled to survive since the 2008 housing crash and have been closing plants for years. On top of this, the U.S is currently undergoing a general labor shortage which is particularly significant in the blue-collar job market. Importantly, nearly the entire lumber supply chain (forestry, milling, transportation, and construction) is dependent on this dwindling labor force.

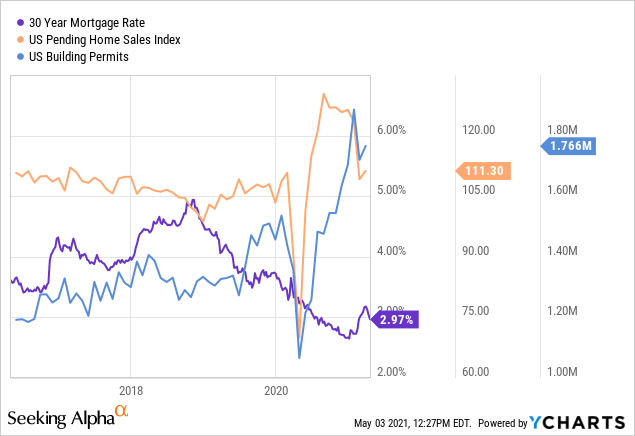

The second major reason for the boom is the Federal-reserve driven decline in mortgage rates and increased stay-at-home activity. This has caused a large increase in home-buying activity and has encouraged many builders to aggressively acquire and develop new properties. See below:

As you can see, the decline in mortgage rates has led to a boost in home sales and building permits. That said, pending home sales appears to be peaking while building permits remain high. In my opinion, this is an initial sign that the market is nearing a cyclical peak which will likely end in a drop in lumber prices.

This could be bad news for timber stocks like Weyerhaeuser, which have risen on the back of the “lumber bubble.” Weyerhaeuser is the leading timberland owner in North America, with over twelve million acres in holdings. The company is a real estate investment trust which generates money primarily through timberland growth and wood products made from those trees. As lumber prices skyrocket, its wood products division has seen its EBITDA rise dramatically. This has caused WY to rise dramatically, but the firm may be overvalued if lumber prices reverse.

The “Lumber Bubble” Cannot Be Sustained

I was bullish on the lumber and construction industries back in 2019, well before the recent boom. However, I’ve been increasingly skeptical over the past few months. It seems that the extreme spike in home sales last year is unlikely to persist, but that builders are so assured that it will that they’re willing to pay such extreme amounts for lumber. There has been a negative shift in pending home sales, which may signify that the rush to complete homes by summer may be futile.

If these trends continue, then it may be the case that builders are, once again, overdeveloping. Builder margins are already threatened, considering the price of construction is rising dramatically due to the lumber and labor shortage. If demand for homes declines over the next two years, as I suspect, then another housing glut will form, and property prices will decline. This will be exacerbated if mortgage rates rise as I suspect they may.

Overall, I believe that the construction market’s current situation is likely to reverse over the coming years. The blue-collar labor shortage will almost certainly persist if not worsen, but the boom in housing construction seems unlikely to last. The labor shortage may keep lumber prices at an increased level, but it will also increase the supply chain’s operating costs so that profit levels may return to historical norms.

Assessing Weyerhaeuser’s Long-Term Value

Weyerhaeuser generally earns around $200-$400M in adjusted EBITDA per quarter. From late 2019 to early 2020, EBITDA was nearly evenly split between its timberlands and wood products segments, with a small degree of earnings from its natural resource leasing segment. However, the company has seen its quarterly adjusted EBITDA from wood products rise from its normal ~$100-$200M to $530M in Q4 2020 and a staggering $889M in Q1 of this year. Importantly, there is no shortage of trees but a shortage of mills that make those trees into (primarily) building materials. As such, Weyerhaeuser’s timberlands income is virtually unchanged.

The question is not whether or not lumber prices will decline, but how high will they rise and how soon will they reverse. In my opinion, we’re probably reaching peak lumber prices today as builders are currently racing to complete projects to meet summer contracts. Indeed many contractors may actually be losing money despite heightened demand. However, failure to deliver would result in a breach of contract, so many are willing to pay virtually anything to get their hands on lumber. I believe this surge will end by July as contracts are filled, and demand for lumber reverses to normal.

This is generally reflected in Weyerhaeuser’s quarterly EPS consensus estimates. The firm’s EPS is expected to rise to around $1 this quarter and then quickly decline back to $0.3-$0.4. See below:

(Seeking Alpha Weyerhaeuser Earnings Outlook)

Personally, I believe the drop in Q3 could be even larger than anticipated since the rise in lumber prices is due to a build-up in summer construction contracts. Demand may persist, but I do not believe it will last as it seems that the housing market may be facing a general glut.

Weyerhaeuser is expected to earn around $1.4 per year under the current earnings outlook, which is about half of its forward EPS of $2.9. While WY has an attractive forward “P/E” of 13.3X, its true long-term forward “P/E” is around 28X. This is a bit high given the company cannot grow without raising cash. The firm also has a dividend yield of around 1.3%, which is very low considering it is a REIT. Based on historical norms, I estimate the company’s fair-value long-term “P/E” is likely closer to 18-22X, which gives it a price target of around $25-$31.

Long-Term Risks Facing Weyerhaeuser

While it seems that Weyerhaeuser may be overvalued, the company is far less expensive than many stocks today. Indeed, a land-owning giant like Weyerhaeuser offers investors a potential inflation hedge which could prove invaluable in the current precarious monetary environment. That said, there are other long-term risks investors may want to consider.

Some evidence today suggests we could see a repeat of the 2008 scenario. While this may not seem to be the case given the booming housing market, there are also historically high levels of non-paying mortgagees. While there has been a slight improvement over recent months, the improvement may be due to short-term factors such as government stimulus and tax returns. Once the government allows for foreclosures, there may be a substantial increase in housing inventory, leading to another multi-year period of low building starts – and therefore depressed lumber demand.

Overall, I would avoid Weyerhaeuser at its current price. The company is still a decent long-term buy-and-hold given its substantial real assets. That said, it is a bit expensive when we look “around the bend” regarding the irrationally priced lumber market. While I am not overly bearish, I do not believe WY will maintain its current price level by year-end.