G0d4ather

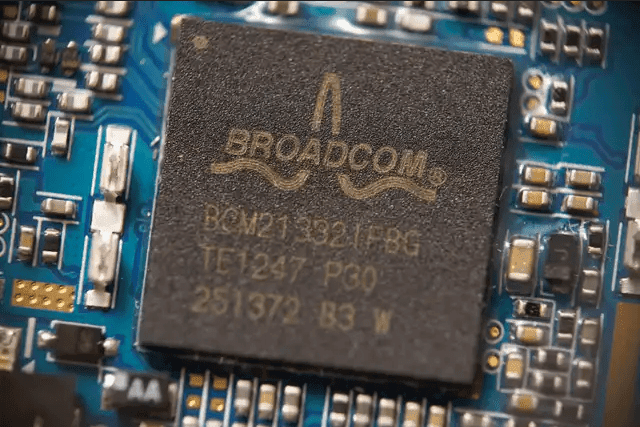

- Broadcom is an expensive but promising semiconductor company with long-term growth potential.

- The global semiconductor industry is expected to reach $1 trillion by 2030, driven by trends in remote working, AI, and electric vehicles.

- The Company’s financial analysis shows strong net income and potential for 15% annual EPS growth, but caution is advised regarding its balance sheet.

- With the current valuation exceedingly high and geopolitical risks surrounding technology companies, my rating for AVGO stock is a Hold.

G0d4ather

Broadcom (NASDAQ:AVGO) is expensive right now, yet as one of the leading semiconductor companies in the world, I think it has a place in technology portfolios. My analysis shows investors are paying a significant premium if buying now, but operations and financials will contribute to continued long-term growth for the firm. As an investor focusing on 10+ year investment horizons, I consider AVGO worth holding for the long term.

READ FULL ARTICLE HERE!