Summary

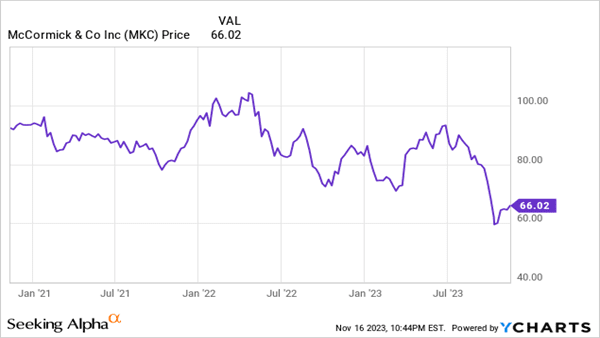

- McCormick’s stock has dropped 30% from its 52-week highs, but caution is advised due to low revenue growth not justifying the 27.7x TTM P/E.

- The company’s profitability has been declining over the past 5 years, with a significant decrease in gross margins.

- McCormick’s high level of goodwill (66.3% of assets), combined with low revenue growth and declining profitability, raises serious concerns about potential impairments.

McCormick (NYSE:MKC) stock has declined around 30% from 52-week highs but there is good reason for it and investors should be cautious. The company is not cheap enough to peak my interest as revenue growth has been only 4.3% over the past 5 years despite notable acquisitions. Furthermore, earnings growth has been negative over the period due to gross margins shrinking continuously from 43.8% in 2018 to 36.7% in the TTM period. This is a significant decline for what should be a consumer staple company with a mature business and great brands. Until I see this trend stabilize and show signs of reversing, I would be wary to be an investor in this company as it looks to be in decline and at risk from goodwill impairments.

Quick Intro to the Company

McCormick is a manufacturer, marketer, and distributor of seasoning mixes, condiments, and other flavorful products that dates back to 1889. Fun fact, which also speaks a bit to the barriers to entry and economic moat of the company, founder Willoughby McCormick started the company in the basement of a Baltimore home in 1889 going door-to-door selling the company’s spices and extracts. The company now sells its products in over 170 countries and segments its business into two main segments; Consumer and Flavor Solutions. While the company’s products might be by definition close to commodities, the company’s scale, supplier relationships, and distribution network have allowed its products to earn a spot on major groceries’ shelves and be the go-to supplier for food manufacturers and foodservice businesses.