Summary

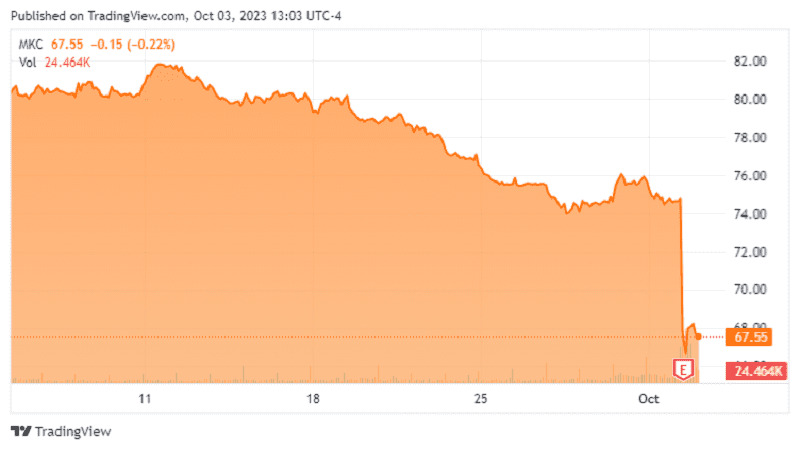

- McCormick & Company, Incorporated bounced right after our last article and then slowly gave back all those gains.

- The company’s Q3 2023 results were in line with estimates, but a significant decline in consumer sales in the Asia-Pacific region raises concerns about future growth.

- We expect earnings to actually stay flat for the next year and valuation compression should pick up speed in that environment.

- Looking for option income ideas that focus on capital preservation? I offer this and much more at my exclusive investing ideas service, Conservative Income Portfolio. Learn More »

You often regret making unequivocal statements in the capital markets. You also tend to regret pushing for fundamental changes in the face of conflicting technicals. We got a dose of the two in our last article on McCormick & Company, Incorporated (NYSE:MKC).

We would not be surprised to see this at even a 16X earnings multiple in 3-4 years. That would be a very unpleasant journey even discounting above average growth rates for the company. At present the stock looks oversold and perhaps you get a bounce here. Longer term, we don’t see this as an ideal buy point. We think we will get that though within the next 12 months and it likely will be at least 30% lower. We rate this as a Sell.

Source: Bubble Valuations Have Not Deflated, But The Thyme Is Cumin.

While we did cover the posterior with the “bounce” part, it was still not the best time to issue a Sell rating in the face of such an oversold stock. The stock promptly went up 25% and rubbed red chili pepper right into our wounds.

But of course, the fundamentals came back to haunt eventually.