Dividend-paying housing investments to purchase extend outside traditional builders that I featured in my stock column and my dividend column last week.

The dividend-paying housing investments to purchase outside traditional builders provide ways to profit from the ongoing economic recovery that is sending the industry to record levels amid the battle against COVID-19. There not only are more real-estate agents than homes for sale in the United States right now, but the domestic housing market is 3.8 million single-family homes short of meeting consumer demand, according to mortgage financier Freddie Mac.

The dividend-paying housing investments to purchase feature companies that cater to industry niches. The U.S. Commerce Department reported on April 16 that domestic home building neared a 15-year high in March but warned that increasing lumber prices and supply constraints could limit home builders and other industry companies from continuing to boost production sufficiently to satisfy huge housing demand.

Dividend-paying Housing Investments to Purchase Gain Attention from Money Manager

“Investors find a lot of the peripheral construction stocks challenging for two reasons,” said Hilary Kramer, who hosts the nationally aired “Millionaire Maker” radio program and leads the GameChangers and Value Authority advisory services. “First, for companies like Johnson Controls Inc. (NYSE:JCI), a housing boom just isn’t enough to offset a slack commercial real estate environment. I love what the residential market does for JCI, but I still can’t bring myself to buy the stock right now. Second, the materials sector has already baked in years of infrastructure spending that never happened, which makes the stocks a lot less attractive for those trying to buy in today.”

Kramer advised those who are bullish on infrastructure to seek exposure to materials stocks selectively.

“Don’t buy the most popular names and work down the list. Start with the stocks that are still relatively cheap relative to their growth rates. U.S. Concrete Inc. (NASDAQ:USCR) is no bargain at 28X earnings but, given its anticipated growth trajectory, it’s still a prize compared to Vulcan Materials Co. (NYSE:VMC) at 35X or Martin Marietta Materials Inc. (NYSE:MLM) at a 31X multiple. And if you don’t like cement, Freeport McMoRan Inc. (NYSE:FCX) gives you copper and a much more dramatic post-pandemic rebound than all these companies put together.”

Mortgage Underwriters Get Spots With Dividend-paying Housing Investments to Purchase

Second, think about investing in mortgage underwriters, Kramer said. Mortgage REITs like Annaly Capital Management Inc. (NYSE:NLY) and AGNC Investment Corp. (NASDAQ:AGNC) suffered a few years ago when interest rates inverted and then got “pushed to the curb” in the pandemic, but they’re rebounding now, she added.

New York-based Annaly Capital Management, a mortgage real estate investment trust, invests its residential assets primarily in agency mortgage-backed securities and debentures. The REIT offers a forward dividend yield of 10.05%, a price-to-sales ratio of 31.44% and a consensus forward price-to-earnings ratio of a modest 8.1%, according to Morningstar.

With a double-digit-percentage dividend yield and a low price-to-earnings ratio to entice investors, the REIT has jumped 8.45% in the past three months, 6.27% so far this year and 65.65% in the past year. Despite those strong gains, investors should consider that the sector’s average return exceeded 14.51% in the past three months, 14.55% so far this year and 90.13% in the last year.

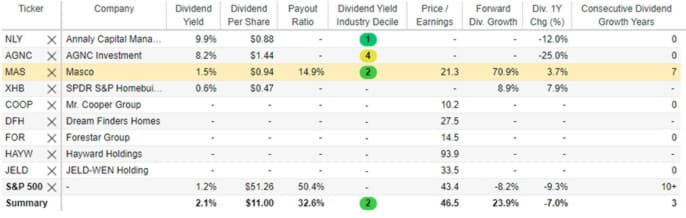

Source: Stock Rover. Click here to sign up for a free trial for Stock Rover charts and analytics.

Low Rates, Economic Recovery Aid Dividend-paying Housing Investments to Purchase

Housing stocks should benefit as interest rates stay low and the economy recovers from the pandemic, said Bob Carlson, who leads the Retirement Watch investment newsletter. They further will benefit longer term as millennials age and enter their prime home-owning years, he added.

But home builders’ profitability is limited by shortages of labor and materials, even though they help to prevent overbuilding and keep demand high, Carlson continued.

Pension fund and Retirement Watch leader Bob Carlson answers questions from Paul Dykewicz prior to COVID-19-related social distancing.

Carlson, who tends to favor investing in funds than individual housing stocks, said one way to invest in the industry is through SPDR S&P Homebuilders (XHB), an exchange-traded fund (ETF) that has risen about 26.83% so far this year after zooming 132.11% during the past 12 months. SPDR S&P Homebuilders is intended to provide investment results that correspond to the total return performance of the S&P Homebuilders Select Industry Index, before fees and expenses. Income investors will like its 0.73% dividend yield.

Dividend-paying Housing Investments to Purchase Offer Alternatives to Mr. Cooper

Jim Woods, editor Successful Investing, Intelligence Report and Bullseye Stock Trader, recommends mortgage servicing company Mr. Cooper Group Inc. (NASDAQ:COOP), which he learned about firsthand when it serviced the mortgage on his home. The company bought his mortgage from another servicer, but usually derives most of its revenue from new home loans, also known as originations.

The new residential mortgage loans are made through a direct-to-consumer channel, offering refinance options for existing customers by purchasing or originating loans from mortgage bankers and brokers, Woods said. When using Bullseye Stock Trader criteria screens on COOP, Woods spotted strong earnings growth, with the company’s estimated earnings per share (EPS) rising 112% in 2020 and its first-quarter EPS growth expected by consensus analysts’ forecasts to near 230% year over year.

Columnist and author Paul Dykewicz meets with stock picker Jim Woods before COVID-19.

Click here to read the rest of the article.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The book is great as a gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others.