Summary

- An urban exodus is in full swing in the coastal “shutdown cities” where lockdown policies have plunged local economies into an uncontrolled tailspin, backtracking a two-decade-long trend of urban revival.

- Apartment REITs in these “shutdown cities” – NYC, L.A., Chicago, and San Francisco – have seen residents flee to lower-cost and safer suburban markets and more business-friendly Sunbelt metros.

- Outside of these troubled markets, however, national apartment markets have been remarkably resilient during the pandemic. Aided by fiscal stimulus measures, rent collection has been essentially on par with 2019.

- Apartment REIT earnings were negatively impacted by generous pandemic-related concessions. New lease rates dipped, but rent growth remained firmly positive for the REITs that took a more case-by-case approach.

- Selectivity is especially essential, and we’ve continued to prefer Sunbelt and suburban-focused multifamily REITs, which will be beneficiaries of the highly favorable trends in the housing sector over the next decade.

- This idea was discussed in more depth with members of my private investing community, iREIT on Alpha. Get started today »

REIT Rankings: Apartments

(Hoya Capital Real Estate, Co-produced with Brad Thomas)

Apartment REIT Sector Overview

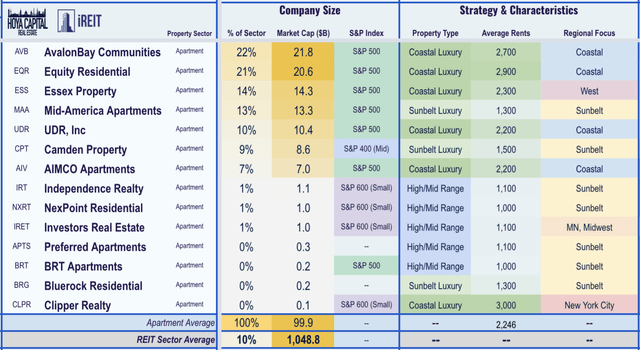

Apartment REITs have been among the strongest-performing property sectors over the last two decades by riding the tailwinds of an unyielding urban revival, a trend that is suddenly severely threatened in several key markets by coronavirus-related economic shutdowns. Apartment REITs in these “shutdown cities” – NYC, L.A., Chicago, and San Francisco, in particular – have seen residents flee to lower-cost and safer suburban markets and more business-friendly Sunbelt metros. Within the Hoya Capital Apartment REIT Index, we track the 14 largest apartment REITs, which account for roughly $100 billion in market value and more than 500k total housing units. Apartment REITs comprise 10-14% of the broad-based “Core” REIT ETFs.

Outside of the troubled “shutdown” metros, however, national apartment markets – along with the broader U.S. housing industry – have been remarkably resilient during the pandemic and have actually been an early leader of the post-pandemic economic rebound. Aided by WWII-levels of fiscal stimulus and robust demand in suburban and semi-urban markets outside of these “shutdown cities,” rent collection has been essentially on par with last year and rental rates have held relatively firm. Apartment REITs comprise 10% of the Hoya Capital Housing Index, the housing industry benchmark that tracks the fundamental-weighted performance of the US housing sector.