JHVEPhoto

Summary

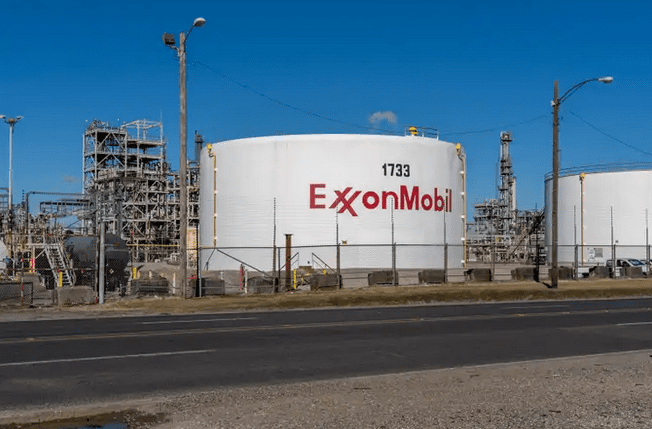

- Exxon Mobil’s purchase of drilling rights for lithium production in Arkansas could open up a high-margin growth opportunity to mitigate the structural decline in its oil and gas business.

- XOM sellers inflicted pain on holders recently as China’s nascent recovery fizzled out, putting a second-half revival increasingly at risk.

- Exxon Mobil must instill confidence in its investors that it has sustainable projects to create new earnings growth drivers, such as lithium mining.

- XOM’s valuation is not cheap but is also no longer overvalued, creating an opportunity for dip buyers to add more shares.

- We’re currently running a sale for our private investing group, Ultimate Growth Investing, where members get access to portfolios, market alerts, real-time chat, and more. Learn More »

I highlighted in my previous article on Exxon Mobil Corporation (NYSE:XOM), suggesting investors consider taking profits and cutting exposure, as its valuations then didn’t support continued outperformance.

XOM sellers delivered a crucial blow as it topped out in February, but buyers jumped at the opportunity to buy the steep pullback toward its March lows.

However, the initial positive reaction to the additional OPEC+ output cuts has fizzled out as investors focused on the tepid recovery of China’s economy.

READ FULL ARTICLE HERE!