Summary

- Going by its competitive position, Google is the strongest tech company on earth.

- It has high market share in most of its markets and practical advantages that could keep the high share going in several of them.

- Bing is not meaningfully eating into Google’s Search market share.

- Google could lose share in search, long-form video, and smartphone operating systems and still be dominant in those markets.

- In this article, I make the case that GOOG is still a mildly appealing buy despite its increasingly rich valuation.

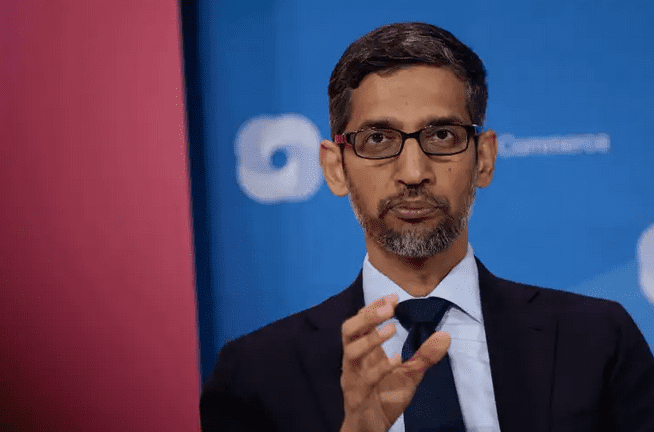

Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) stock, hereafter referred to as “Google,” has been rising lately. Its most recent earnings release was a minor beat, thought it didn’t move the stock much initially. What really got things moving was the company’s efforts in artificial intelligence (“AI”). Google recently put off an AI event that was much better-received than its previous one, which showcased the company’s Bard chatbot making an error. Ever since the second, more successful AI presentation, Google stock has been rallying.

What should shareholders make of all of this?

First things first, I don’t believe that the massive amount of money being piled into companies that mention AI on earnings calls is being spent well. I think that NVIDIA (NASDAQ:NVDA) is way too expensive right now and I think that other tech companies are getting pricey too, albeit to a lesser degree.

READ FULL ARTICLE HERE!