Summary

- Sinclair Broadcast expects to be FCF positive in 2023, even with their large CapEx spending and a weakening ad market.

- SBGI has repurchased 13% of its shares outstanding from January 1st through May 5th.

- The company is creating a new holding company with two subsidiaries (broadcast and ventures) to provide more clarity to the market and potentially increase the share price.

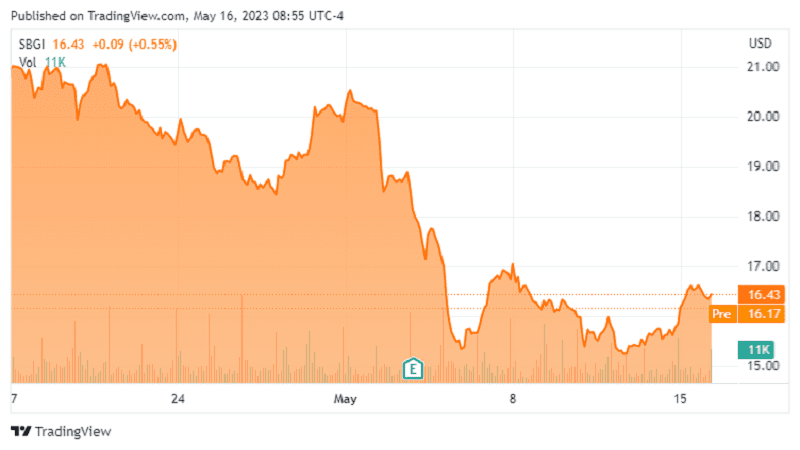

Back in January we discussed why we liked Sinclair Broadcast Group (NASDAQ:SBGI) and how it appeared that the market might be undervaluing the company as the sum-of-the-parts appeared to be worth far more than the market value of the company. Management believed that their investment portfolio alone was worth $1.2 billion, or close to $17/share, and while that was an estimate it seemed reasonable us. Since our last article, Sinclair has decided to undergo a reorganization which will see a new parent company with two main subsidiaries; Sinclair Broadcast Group and Sinclair Ventures (which will hold all of the non-broadcast assets) – which is explained in a little more detail here.

Sinclair’s most recent conference call, where management discussed the reorganization plan and quarterly results, was informative and shed light on the fact that the majority shareholders want to close the gap between what they believe the company is worth and where it is trading on the market currently.