Summary

- McCormick has been underperforming the consumer staples sector in the last year.

- The former high flyer has been weighed down by poor results.

- We take a first look at this company and dissect the valuation.

- Looking for option income ideas that focus on capital preservation? I offer this and much more at my exclusive investing ideas service, Conservative Income Portfolio. Learn More »

McCormick & Company, Incorporated (NYSE:MKC) describes itself as “end-to-end flavor”. We do not disagree.

Company Website

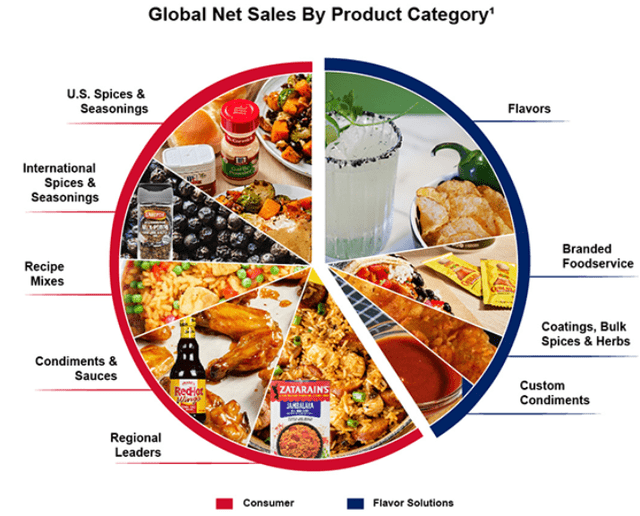

MKC is a global leader in all things flavor, operating in around 170 countries and territories. The company manufactures, markets and distributes products across the spectrum to customers in the food industry.

Its Consumer segment includes popular brands like the eponymous “McCormick”, “Frank’s RedHot”, and “Club House”, along with ethnic and regional brands like “Thai Kitchen”, and “Simply Asia” among others. And this is just a little taste (pun intended) from the North American market. More than half of the Consumer segment comprises sales of spices, seasoning, condiments and sauces, with MKC even occupying the global leader position for the first two categories. Customers for this segment include retailers of all shapes and forms including grocery stores, warehouse clubs, discount and drug stores. They also supply to wholesalers and private label items, aka, store brands.