Summary

- T. Rowe Price is a well-recognized leader in the active asset management business.

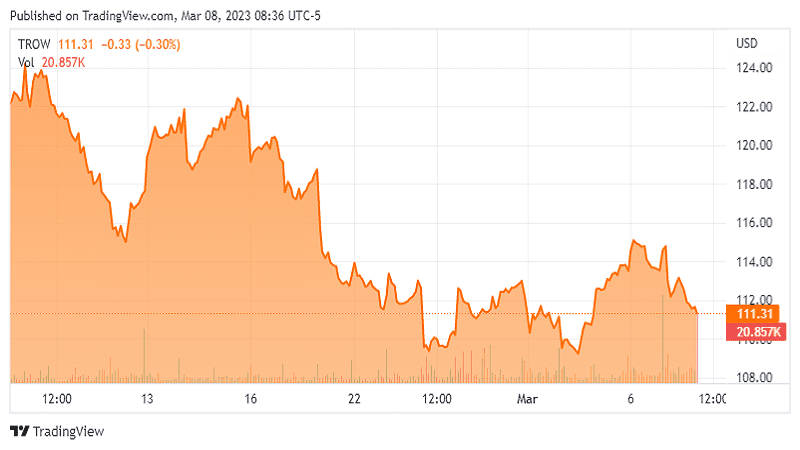

- Its stock has underperformed major market indices this year and saw AUM growth in January.

- It has a strong dividend track record, is actively buying back shares at discounted levels, and is set up for potentially strong long-term returns.

- Looking for a portfolio of ideas like this one? Members of Hoya Capital Income Builder get exclusive access to our subscriber-only portfolios. Learn More »

Most stocks have had a rocky start to 2023 to say the least, with many seeing peaks and valleys in the first two months of the year alone.

For those who can embrace volatility, it’s times like these that mean opportunity, as short term pain can lead to long-term gains. In other words, you pay for a rosy environment, and buying quality stocks when they’re a bargain leads to the best long-term results.

This leads me to T. Rowe Price (NASDAQ:TROW), which as shown below, is now trading at the “foothills” of the mountain from the latter part of 2021. Let’s explore why now may be a great time to pick up this wealth compounder.