Summary

- AvalonBay is a top-quality multifamily REIT, with the distinction amongst REITs of having one of the largest long-term rates of growth of cash earnings.

- Based on their annual filings with the SEC and other information, this article turns them inside out to find out how they do it and to project the future.

- After that, the article considers valuation and presents an argument that AVB and other multifamily REIT stocks may not be undervalued today.

- I do much more than just articles at High Yield Landlord: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

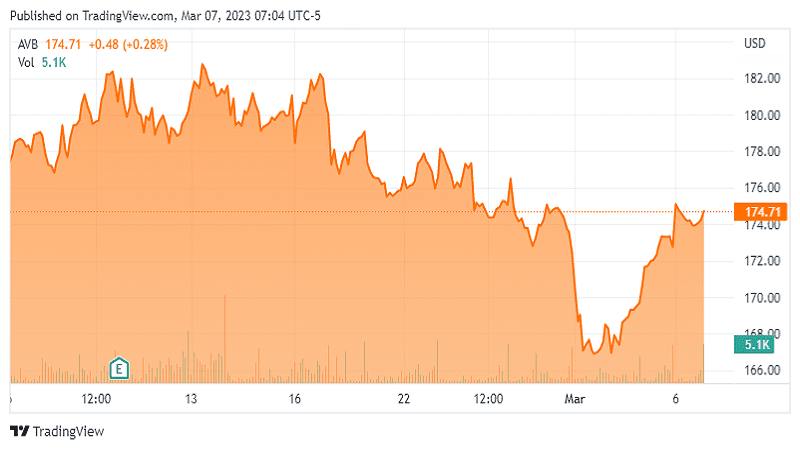

My portfolio has included multifamily REIT AvalonBay (NYSE:AVB) until very recently, although not without mixed feelings. Their excellence and inflation protection battles with a dividend yield that remains low even now.

I bought AVB mainly in late 2021, from the perspective that it would be a good inflation hedge. This is still true.

Other than that, my expectations were for a total return in the high single digits. I sold within the past month for reasons developed here and in my recent article on inflation protection.

But my reasons may not be your reasons. As AvalonBay have just reported their financials for 2022, this is a good time to turn them inside out. At issue is their business model, its security against adversity, and its prospects for growth.

This is the second REIT to get this treatment from me this year. The first was Simon Property Group (SPG).