Summary

- The market is hating legacy market exposure right now, and everyone wants exposure to the Sunbelt region which has likely led to overcrowding.

- Valuations have gotten cheap to a point where we’re essentially buying properties for what it would cost to build them (zero developer mark-up and zero premium).

- Residential REITs in legacy markets are better positioned than their Sunbelt peers with renting much cheaper than owning and significantly lower new supply.

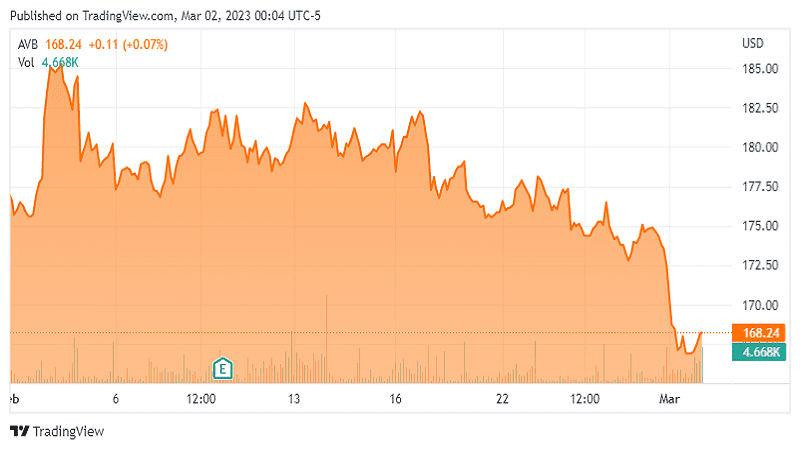

- This has created a great buying opportunity. Below is my thesis for AVB in 2023.