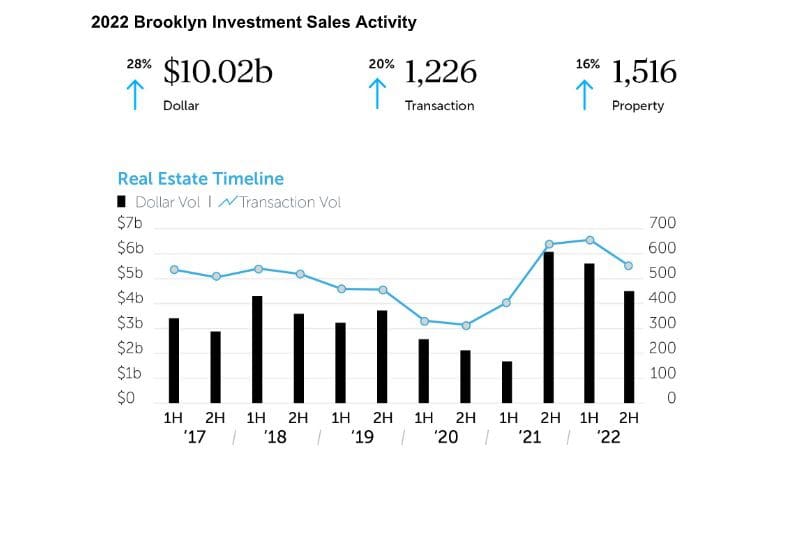

In 2022, Brooklyn saw a 28% year-over-year increase investment sales to just over $10 billion, the first time ever the borough has cracked the $10 billion mark in dollar volume and surpassing the previous record of $9.19 billion from 2015, according to Ariel Property Advisors 2022 Brooklyn Year-End Commercial Real Estate Trends report. Transactions in the borough also increased 20% from the previous year to 1,226.

“Institutional money helped play a major role in the Brooklyn market, as 2022 finished the year with 16 transactions of $100+ million, nearly doubling the nine from 2021,” said Ariel Partner Sean R. Kelly, Esq. “Additionally, several asset classes saw record highs in pricing, and the Multifamily & Industrial/Warehouse classes specifically had their best year ever in terms of dollar volume.”

Stephen Vorvolakos, Director, Investment Sales, added, “Despite several rate hikes and many regulatory and economic concerns, Brooklyn’s investment sales market made tremendous strides in 2022. Building off 2021, which saw rents and vacancy return to pre-pandemic levels, many investors reemerged from the sidelines and helped propel Brooklyn to its best year to date.”

Benjamin Vago, Esq., Director, Investment Sales, noted that last year’s sales provide additional evidence that multifamily investors are changing their preferences. “In Brooklyn’s multifamily sales in recent years, there has been a noticeable shift towards smaller, primarily free-market buildings that are not subject to rent stabilization,” he said. “Small multifamily buildings with fewer than six units accounted for over 50% of the multifamily transactions in 2022. This is a trend we expect to continue into the foreseeable future as investors more aggressively pursue value add opportunities.”

The following is a summary of the report:

Multifamily

● The Brooklyn multifamily market had its strongest year to date in 2022, finishing with 807 transactions, the most ever recorded in the borough. This represents a 29% increase from 2021’s 624 transactions.

● Dollar volume finished the year at $5.3 billion, also an all-time high, and a 10% increase from 2021. Excluding the Starrett City Portfolio partial interest sale in August 2021 for $1.3 billion, the year-over-year dollar volume would have increased by 33%.

● The average price per square foot reached $459, a 23% increase compared to 2021 and the highest average ever recorded in the borough.

Development

● The June 15th expiration of the 421a tax abatement helped to spur activity within Brooklyn’s development market early in 2022 as developers rushed to get their shovels in the ground.

● Although the first half of the year was more active, the development market finished the year with 166 transactions, a 10% increase, and dollar volume of $1.6 billion, a 30% increase.

● The average price per buildable square foot rose to $278, a 10% increase compared to 2021 and the highest average ever in Brooklyn.

● Williamsburg continues to be the hot spot for development in Brooklyn. Its 33 transactions totaling $325 million accounted for 19% of sales this year, however, we have seen a significant increase in activity in surrounding neighborhoods as well.

● Gowanus transaction volume saw a strong uptick with 8 transactions, doubling its total from 2020 & 2021 combined. Madison Realty Capital’s purchase of 350-355 Hicks Street in Cobble Hill for $142 million was the largest development site sale in Brooklyn since 2019. The next two highest sales were in Flatbush and Brighton Beach.

● As developers spread throughout Brooklyn, they are also increasing their scale. 2022 saw 38 transactions of $10 million or more, a 31% increase from 2021.

Industrial/Warehouse/Storage

● The Industrial/Warehouse market continues to thrive in the post pandemic era as more retailers shift into the online space.

● Dollar volume totaled $1.3 billion, a 76% increase year-over-year, the highest amount ever recorded in Brooklyn, while transactions were flat at 99.

● This dollar volume increase can be attributed to the $332 million sale of 640 Columbia Street in Red Hook and the $228.5 million sale of 554 & 578 Cozine Avenue in East New York, both in the first half of 2022. Both properties are fully leased to Amazon and are the two largest industrial/warehouse sales ever in Brooklyn.

● Red Hook continues to be a leader in the industrial market due to its centralized location and proximity to all major roadways and waterfronts. In addition to the Columbia Street sale, Red Hook saw six transactions totaling $70 million in 2022.

● The $492 per gross square foot average is a Brooklyn record, surpassing 2021 of $425 by 14%, which was the previous high.

Commercial

● Year-over-year, dollar volume declined 6% to $491 million, and transactions totaled 102, which is the third highest transaction volume on record.

● The largest commercial transaction of the year was the Chetrit Groups’ $34 million sale of 1100 Kings Highway & 2067 Coney Island Avenue in December, which was sold to an owner-user for $1,153 per square foot.

● 72% of commercial transactions were below $5 million and 56% were below $3 million. Due to this smaller scale, the average price per square foot was a record $666, narrowly surpassing the previous high of $665 from 2016.

● Smaller mom & pop retail in low-density neighborhoods are driving the activity in this market. This year, only seven of the 96 commercial sales occurred in “prime” neighborhoods like Williamsburg, Greenpoint and Downtown Brooklyn. All other sales occurred in Central and South Brooklyn, with Sheepshead Bay and Borough Park leading the way.

To read the full Brooklyn 2022 Year-End Commercial Real Estate Trends report, click HERE.

About Ariel Property Advisors

Ariel Property Advisors is a commercial real estate services and advisory company located in New York City. The company covers all major commercial asset types throughout the NY metropolitan area while maintaining a very sharp focus on multifamily, mixed-use and development properties. Ariel’s Research Division produces a variety of market reports that are referenced throughout the industry. arielpa.nyc