Summary

- Host Hotels & Resorts has continued to see strong revenue growth.

- Even in spite of rising hotel prices, demand continues to increase.

- I take a long-term bullish view on Host Hotels & Resorts.

Investment Thesis: Host Hotels & Resorts (NASDAQ:HST) could see long-term upside given strong revenue growth despite rising hotel prices.

In a previous article back in September, I made the argument that Host Hotels & Resorts could see upside on the basis of an encouraging rebound in RevPAR (revenue per available room) and the potential for a further boost in revenue from the Maui/Oahu portfolio during the winter months.

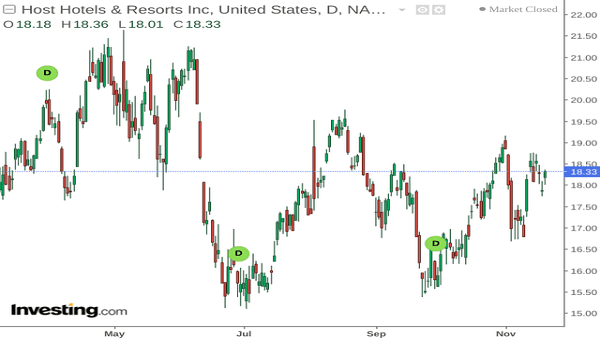

With that being said, we can see that the stock still trades below levels seen in May:

The purpose of this article is to assess whether my case for upside still holds in light of recent earnings results, and whether the stock could be poised for upside from here.