Summary

- T. Rowe Price has already brilliantly overcome phases when AUM was in trouble.

- From a fundamental point of view, this company is out of the ordinary.

- The current price is still too low compared to the fair value.

It has not been that long since my last article on T. Rowe Price (NASDAQ:TROW), however, I decided to do another one as there are some updates related to the latest quarterly report. Also, unlike the previous one, in this article the valuation will be done by discounted cash flow and not by evaluating price multiples. Finally, to support my bullish thesis, I will use economic/financial data achieved by T. Rowe Price over the past 10 years.

Comment on Q3 2022

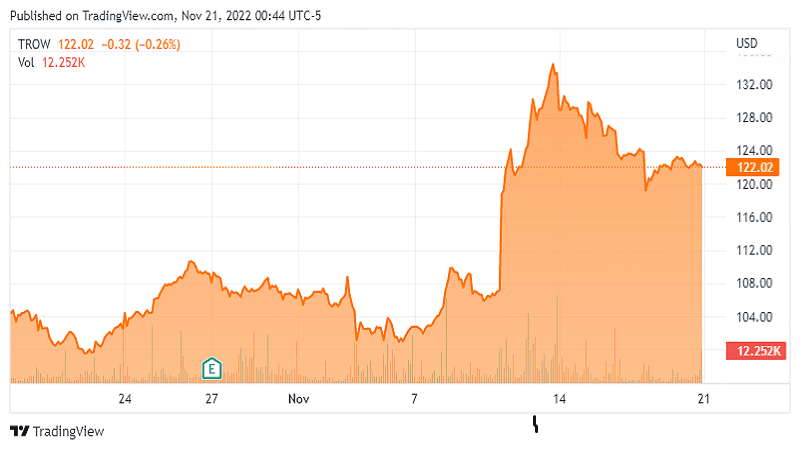

The macroeconomic situation remains precarious as the FED continues to aggressively raise interest rates and both the bond and stock markets are struggling. After an encouraging downward CPI for October, the chances of inflation peaking have increased, but there are still many doubts about this. With such uncertainty in the financial markets, we certainly could not expect encouraging data for this Q3 2022 from T. Rowe Price. The stock market euphoria that characterized 2020 and 2021 is now a distant memory, and T. Rowe Price’s AUM continues to decline very quickly.