Summary

- The Chinese boycott of Nike products in response to Nike’s boycott of Chinese Xinjiang cotton is actually a bullish catalyst for Nike.

- Earnings sentiment is returning to average, predicting a better performance over the coming quarter.

- The recent gap is, however, is a short-term bearish signal.

- Looking for more investing ideas like this one? Get them exclusively at Exposing Earnings. Learn More »

I am here to update Nike (NYSE:NKE) shareholders on three pressing issues regarding the direction of the stock:

- The Chinese “boycotts”

- Management sentiment

- The up gap

I can provide some relevant context on the macro factors influencing Nike’s sales going forward, especially those playing out right now in China, which could be the most influential factors on the stock in the medium-term. In addition, we should discuss the sentiment change from the newest earnings report. We have looked at trading NKE over earnings in the past, but today I’d like to talk about the sentiment implications on trading NKE after earnings. Finally, we should look at the gap down in NKE that occurred yesterday, as it provides a high-return trading opportunity.

Macro Factors

I believe the three most relevant macro factors at the moment are the China boycotts, consumer spending patterns, and the stimulus checks.

The latter two are linked. We know that consumer spending is down, judging from the 3% retail sales drop in February. The stimulus checks and unemployment benefits are likely to help retail sales bounce back upward, and this certainly applies to Nike.

We already know Nike – and other sneaker companies – are large beneficiaries of the stimulus package. The $1.4k stimulus checks represent a one-time boost to Nike’s sales figures, a boost that will be seen in next quarter’s earnings report. Clearly, demand for Nike’s products rises with spending power, which is a bullish catalyst considering the US is opening back up – and ability to “employ” Nike’s products (i.e., more social interaction with which to show off your new sneakers and more sports activities) should also be seen as bullish factors for Nike.

In the meantime, the boycott of Nike shoes in China is spooking some investors and has certainly been incorporated to some extent into the stock. The western media outlets are reporting boycotts and negative online sentiment against Nike in China. Professionally fluent in Chinese, I always find it useful to actually turn to the Chinese side of the internet for confirmation.

I found that this boycott is more likely a medium-term bullish catalyst, much like the stimulus checks. That is, we will see increased sales numbers in Nike’s next earnings report, despite the western media pointing to a business dilemma in China. Allow me to explain.

The call for boycotts seems to have originated not organically from consumers but from government officials. CCP officials, reacting to Nike’s refusal to use cotton in Xinjiang due to the possibility of the labor producing said cotton to be misaligned with the US concept of human rights, stated that – more or less – the Chinese populace do not want to purchase products that refuse to employ Chinese-sourced resources. Many western media sources jumped the gun, reported actual boycotts.

Yet once you dig deeper, you find the opposite of boycotts: mad rushes to the stores to buy up Nike shoes. These buying crazes seem to be out of fear (however misguided) that the Chinese government will enact bans or tariffs on Nike shoes and other US brands. And so the result is a boycott that looks like this:

and this:

So does this mean that the boycott fears are invalid? Well, I did find one instance of a pro-China protestor, holding a sign that says, “I support Xinjiang cotton,” but she was alone and was ironically forcefully removed by the police, those working for the exact same government that can be said started the boycott rumor:

Notably, on Friday, “Nike” was the top trending term in Weibo (WB), with over 300% more activity than that in second place – H&M (OTCPK:HMRZF), another foreign company entangled in the Xinjiang cotton discussion. Predictably, this has led to increased purchases in Nike’s shoes, with a notable example of a new Nike release getting nearly 400,000 preorders in a single day. In short, I’m seeing a lot of discrepancies between the western media reporting on the Nike “boycott” and the Chinese side of things.

This reminds me a lot of early 2020, when China was talking about the new coronavirus pretty much all day long. The west pretty much dismissed it as small news, and this discrepancy pushed me to take out large short positions on the general market and on cruise lines, all before the market actually dropped. This sort of informational advantage is extremely useful in making profits in the market, and we are seeing the same sort of thing now, with Nike.

Earnings Sentiment

As Nike just reported its FQ3 2021 earnings, we can now update our sentiment scores for the stock. In short, I use financial lexical analysis to analyze management and shareholder sentiment from the earnings call, arriving at a sentiment score, which is essentially the ratio of optimistic to pessimistic forward-looking statements. We mainly wish to look at the changes of sentiment quarter over quarter and year over year to see whether we can expect excess gains or underperformance.

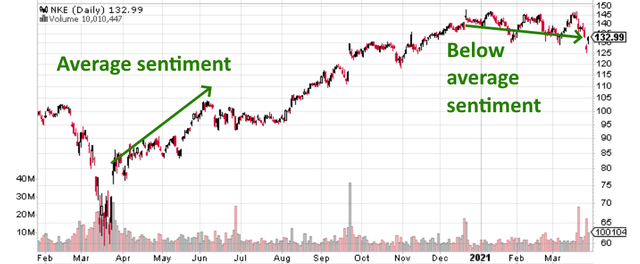

Running this analysis over Nike, I found that this company’s sentiment has one of the lowest variances of the stocks I’ve looked at over the past few years. However, even the small deviations from average sentiment seem to perform quite well in predicting excess (read: better than statistically predicted) gains. For the current quarter, Nike’s sentiment is showing a recovery toward its average sentiment level, up 10% quarter-over-quarter:

(Source: Stockcharts)

From sentiment alone, the implication is a return to stable upward momentum. That is, the coming three months should show better performance than the past three months. Nevertheless, sentiment is still roughly 10% lower than average, so we should not expect the type of growth we saw one year ago.

Gap Implication

Yesterday, NKE showed an up gap. To me, this looks like an area gap because of the candlestick pattern, the size of the gap, and the volume on the gap day. I want to backtest whether this is an area gap because if it is, we don’t want to take a long position on the sentiment trade just yet – in fact, we probably should take a short position to play the short-term gap trade, only afterward swinging long in-line with sentiment and the macro factors:

(Source: E-Trade)

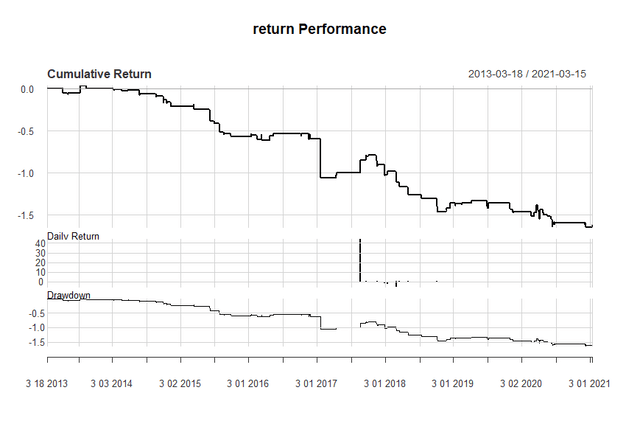

A nice thing about playing gaps on NKE is that it has a long history, allowing for lots of data. I ran this backtest through the current volatility regime and found NKE’s post-gap price action to be quite consistent. Here is the performance of going long on NKE after this type of gap:

(Source: Damon Verial; data from Tiingo)

Likewise, here is the result of going short after these gaps:

(Source: Damon Verial; data from Tiingo)

This equates to an annual return of 13% just from going short the day after such gaps. I like this type of area gap quite a bit and intend to trade it via options. My price target is $129.39, which is where the gap fills.

Here is my play:

Buy Apr16 $138 puts

Once the gap fills, I will convert to a long position, taking advantage of the informational discrepancy between the US and China as well as the sentiment increase, which is also a factor mostly hidden from the average investor. But for now, I trust the technical short-term pattern suggesting the gap will fill – I have built my trading career on gaps, after all. So, in short, go short NKE in the short-term, and then go long for the medium-term (up to the next earnings report).

Happy trading.