Summary

- Comcast announced its second quarter results in late July. Investors were terrified by the lack of growth in broadband subscribers. I will explain why the concerns are largely unfounded.

- The depreciation of the British pound and fears of a recession have put further pressure on the stock, which now yields 3.5% – almost double the long-term average dividend yield.

- Investors should buckle down and focus on the company’s unwavering ability to generate strong cash flows that are generously returned to shareholders.

- I will outline why I believe CMCSA stock is a significantly undervalued dividend growth stock that will reward patient investors with a substantial yield on cost in a few years.

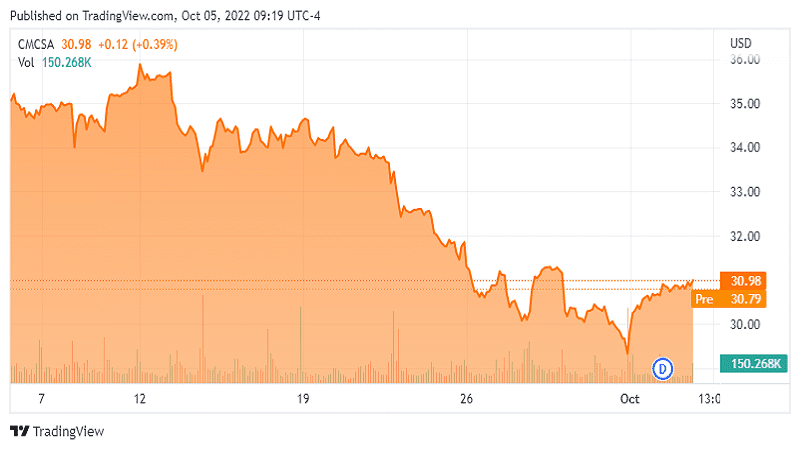

- At current valuations, CMCSA is one of Mr. Market’s more generous current offerings, and accordingly, I added significantly to my position during last week’s rout.

Introduction

I first covered Comcast Corporation (NASDAQ:CMCSA) in a comparative analysis back in April, when the stock was trading in the mid-$40 range. Even then, I thought it was an acceptable value, but in the meantime, things have turned out much better from the perspective of a contrarian value investor.

In this article, I will outline why I think the stock is a highly promising value, especially for dividend growth investors, based on the company’s second quarter 2022 results.

Key Takeaways from Comcast’s Second Quarter Earnings Call

Strong Free Cash Flow From The Cable Segment

Primarily due to the difficult environment due to the virus-related lockdowns in 2020, many companies were faced with significant working capital-related challenges in 2020 and 2021. The consequences in 2022 in many cases are bloated inventories, and with consumer sentiment increasingly deteriorating, many companies are forced to mark down items to generate needed operating cash flow.

Comcast, as a telecommunications company, does not rely on substantial working capital in the traditional sense (i.e., inventories). For this reason, and because the company relies heavily on cable fees, it continued to generate strong free cash flow in 2020, even though the company’s Theme Parks and Studios segments suffered a major setback due to pandemic-related measures. Figure 1 shows Comcast’s free cash flow trajectory from 2010 to 2021, normalized for working capital movements, stock-based compensation expense and impairment charges. While the $16.1 billion in free cash flow generated in 2021 looks like a one-time event, Comcast can be expected to generate at least $16 billion in free cash flow in 2022, as the company has already generated $8.6 billion in the first half of the year, representing 6.4% year-over-year growth. That puts its forward free cash flow yield at a whopping 11.5%.