Summary

- The past two quarters represented a stress test for Tesla.

- It had to deal with a number of challenges, including limited production, shutdowns at its Shanghai factory, soaring costs, et al.

- However, its June-quarter results topped expectations largely driven by a healthy ramp-up of total deliveries despite all the challenges.

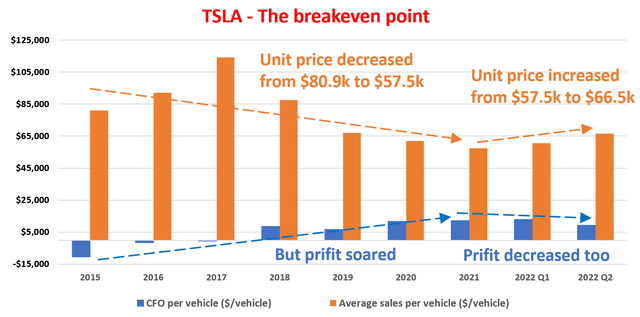

- It also demonstrated its pricing muscle and showed that its production has clearly passed the pivot point of the critical scale.

- Going forward, I expect it to recoup its fixed cost at an even faster pace and benefit from the scale of production to a further degree.

- I do much more than just articles at Envision Early Retirement: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Thesis and Background

Tesla (NASDAQ:TSLA) essentially took a stress test in the past two quarters. And to investors’ relief, it passed the test. Although we look more closely (which we will in the next section), there are still some lingering issues in its scorecard. But overall, its June-quarter results topped expectations despite the multitude of challenges it faced in the first half of the year, including limited production and shutdowns at its factory in Shanghai for most of the quarter, ongoing supply-chain disruptions, and rising labor and raw materials cost. Despite all these challenges, revenues for the June quarter went up 42% YoY and the total deliveries reached almost 255K (a 27% increase YoY). Looking forward, management is targeting record production in the second half of the year.

READ FULL ARTICLE HERE!