Summary

- SBUX is in a strong uptrend.

- Results aren’t back to normal, but they’re getting there.

- SBUX will see many benefits from reopening and it is a buy.

Consumer discretionary stocks as a group suffered immensely during the initial stages of the pandemic. Consumers began saving instead of spending, and with tens of millions of people suddenly no longer commuting, companies like caffeine legend Starbucks (SBUX) saw traffic (and earnings) plummet. However, those days are gone, and Starbucks is booming.

Starbucks has now rallied well past its pre-pandemic high, and it is vastly outperforming its peer group, restaurants and bars. I happen to be bullish on consumer discretionary given the vaccine rollout is flying along, consumers are flush with cash, and unemployment continues to improve. All of these things are good for Starbucks, and while I don’t think the stock is cheap, necessarily, it certainly looks like more highs are coming.

Assessment of the recovery

It makes sense to start with where Starbucks is relative to where it was both before and during the crisis, given we appear to be on the tail end of it. COVID cases have declined precipitously, and vaccines are flying off the shelves and into the proverbial hands of the people that need them. These are great signs that the worst is behind us, and that “normal” is on the horizon.

For companies like Starbucks that sell things that aren’t a need, and that thrive when people can gather around a table and spend time together, this is the best of news.

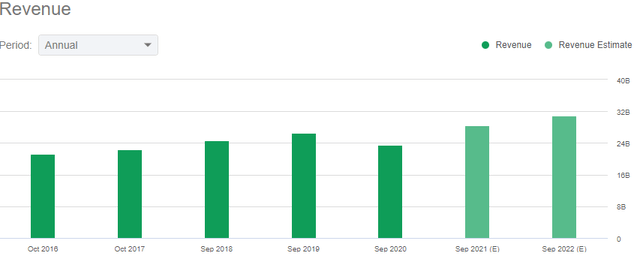

Source: Seeking Alpha

Revenue was previously on course for a new high this year, and then COVID hit. Starbucks suffered immense traffic declines for obvious reasons, but I have been genuinely surprised at how well consumers have responded. I thought the lack of commuting would be a huge hurdle for Starbucks, and for a time it was. But since the fall months, Starbucks has surprised me in terms of its resiliency. As the economy continues to reopen and restrictions are relaxed, this should only improve further.

Current estimates are for revenue to soar well ahead of 2019 levels for this year, and even higher in 2022. This is the growth track we’ve become accustomed to with Starbucks, and I’ll be honest about being wrong about how quickly this would happen.

Looking further out, we can see that Starbucks isn’t even back on what would be considered its prior growth path. While this presents certain challenges, on the whole, it means there is a lot of room for potential further upside.

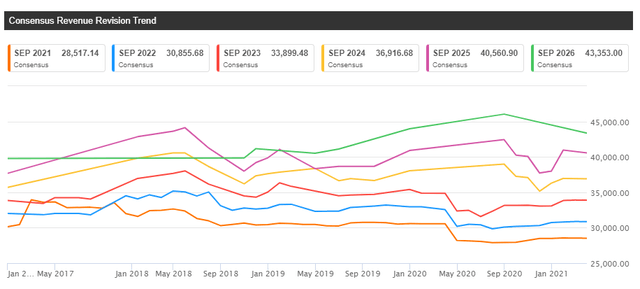

Source: Seeking Alpha

The orange line, which is this year, is nowhere close to its pre-pandemic levels. The same is true for next year, and every year on this chart. I don’t think Starbucks has suffered anything close to permanent damage from COVID, which then implies that these estimates should continue to drift higher back towards pre-COVID levels. Given that Starbucks has, for years, been one of the best run companies in the US, I don’t have any doubt that will happen. The time frame is up for grabs, but I have no reason to doubt the reflation of estimates will occur.

Indeed, Starbucks is already well on its way in this still-pandemic-stricken fiscal year. The worst of the pandemic is now being lapped, so results should begin to normalize a bit, but Starbucks is on pace for a massive rebound in comparable sales this year.

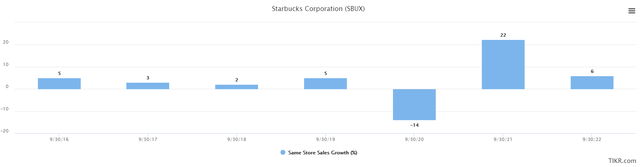

Source: TIKR.com

After 14% decline last year, estimates are for +22% this year and +6% next year. The big question mark at this point is traffic, which was down 19% in the most recent quarter. That’s ugly, but we know it is due to many localities still having restrictions in place. As we progress in the vaccine rollout, traffic should improve rather quickly, and with the pricing power and average ticket size strength Starbucks has shown recently, even just a rebound in traffic to prior levels would be hugely accretive to earnings.

That would certainly go a long way towards normalizing the company’s earnings, because as we’ll see now, margins have suffered since the crisis began.

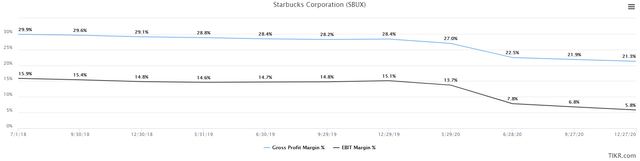

Source: TIKR.com

I’ve charted trailing twelve months gross margin and EBIT margin to give a sense of the impact lower revenue had on Starbucks’ profits. Gross margins plummeted and took operating margin with it because of certain fixed costs, like rent and to an extent, SG&A. However, as revenue returns, we should see a pretty immediate reflation of margins, and with it, profits.

In short, while Starbucks isn’t back to “normal” just yet, all of the pieces are in place for it to do so in the relatively near future. I’m more confident than ever that the vaccine/reopening situation is in full swing, and it is only a matter of time. This is the best news Starbucks could hope for.

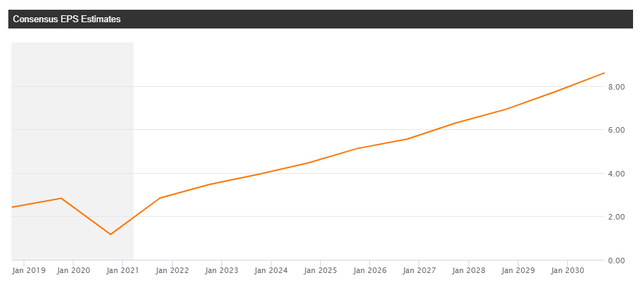

Looking forward

Earnings were unsurprisingly reset lower in 2020, and are still below trend this year. However, if we look below, fiscal 2023 should see Starbucks back on its former path. That’s some time away from now, but as I mentioned above, all the pieces are in place.

Source: Seeking Alpha

With people beginning to commute again, tens of millions of people being vaccinated, and a general sense of pent up demand from consumers yearning to be set free from their lockdown spaces, Starbucks looks like a big reopening beneficiary.

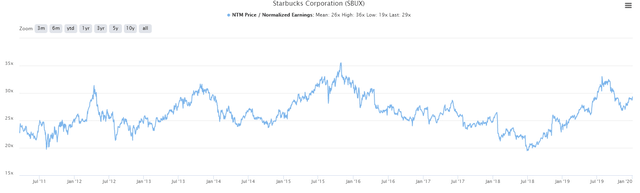

Starbucks isn’t cheap, but it never is; market leaders are that way. Shares trade for ~30 times normalized earnings for next year, which is towards the top end of the historical range.

Source: TIKR.com

However, for a company with a huge moat, a long runway for growth, and a clear catalyst for better revenue and earnings, a high-ish multiple is to be expected. I don’t think Starbucks is cheap, but it is reasonably priced.

The company’s rewards program has 22 million users, which drives customer loyalty and repeat purchases. Average ticket continues to rise while traffic is trying to bounce off the bottom. Given pricing strength, and consumers flush with cash, I suspect we’ll see a very strong rebound in revenue when traffic does return with a virtuous cycle of very high average tickets, and rising traffic counts. The company’s digital engagement has never been better, allowing consumers to order and pay for their drinks in a contactless way that is quick and easy.

In short, SBUX is a prime reopening stock. Shares aren’t cheap, but they’re in an uptrend and I see a lot of fundamental support for that continuing. It is possible we relapse into another shutdown period, but given the tsunami of vaccines being rolled out and generally improving sentiment among consumers, I simply don’t see that as a reasonable possibility. As more and more people are vaccinated, and as cases continue to decline, all restaurants stand to benefit, with Starbucks included.

We mustn’t forget that Starbucks has been able to produce decent results in the past year with huge amounts of capacity restricted. Many stores are operating with only the drive-thru, which restricts capacity. When stores are allowed to be open with all ordering methods available, capacity will immediately increase. Given Starbucks stores are perpetually busy during normal times, capacity is a real constraint. As we get further in 2021, that constraint should be largely removed.

How high could it go? As I said, the valuation is about right today around 30 times forward earnings. I don’t see a lot of upside to that in the coming years, but unless Starbucks botches something in its execution of the reopening, or in expanding its store count, I don’t see a lot of downside either. Starbucks is, as I said, one of the best run companies in the US and has been for a long time. After all, it dominates its niche and you don’t get that way without consistent execution.

Three years from now, Starbucks is expected to earn $4.45 per share. Thirty times that value gives us a projected share price of $133. Starbucks won’t make you rich overnight, but it has a lot going for it, particularly as the economy continues to reopen.

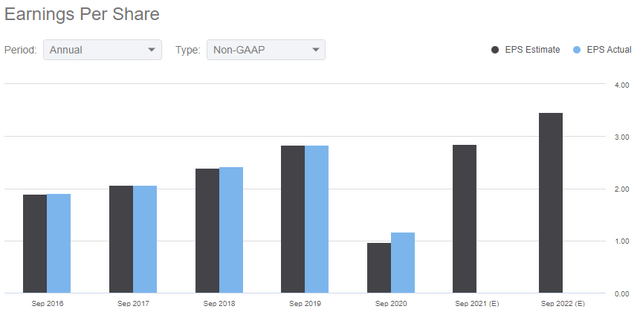

Source: Seeking Alpha

Over the years, Starbucks has done a terrific job of hitting estimates, or exceeding them. We can see the previous five years all hit or beat annual EPS estimates, so concerns over the company missing estimates in the coming years are unfounded. In particular, as I explained I believe estimates in the out years are too low and will be raised, beating current estimates should be rather easy for Starbucks, particularly for next year and beyond, as the economy gets back to normal. Estimates currently aren’t pricing in a return to normal in full; they are pricing in a recovery, but a slow one. That leaves upside potential for estimates in the coming quarters. This is contingent upon capacity being restored in full, so if you don’t believe that will happen, adjust accordingly.

Of course, should this happen, the price target would need to be raised. That extra bonus isn’t needed for the bull case, but I’m certainly not against it.

Risks really just include another wave of shutdowns, because Starbucks has proven over the years that others like Dunkin’ and local coffee shops haven’t stopped its ability to grow. I don’t see that as any different today. In fact, it stands to reason that at least some local competition for Starbucks may have had to fold in the wave of very unfortunate small business failures that took place in 2020. Thus, Starbucks may have even increased its competitive position through this crisis.

Starbucks is already well underway with its rebound, it just needs traffic to come back, which I believe is reasonable to expect as vaccines roll out and localities relax restrictions.

Starbucks has a growth plan it has been executing against for many years, which is to innovate with the menu, expand the store base, invest in digital, and generally seek to wow customers. The rewards program is a tangible outcome of this as customers remain loyal to Starbucks, driving consistently higher volumes and profits.

The pandemic temporarily derailed this, but there is no evidence to suggest anything has changed longer-term. Starbucks is going higher.

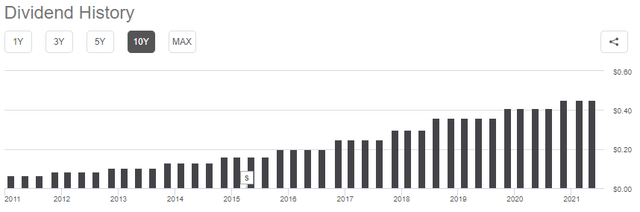

Finally, if it is dividend growth you fancy, you can do a lot worse than Starbucks.

Source: Seeking Alpha

The dividend has grown for 11 years consecutively, and management is clearly committed to continuing to do so. The yield is about equal to the broader market, but with the payout at just 63% of this year’s earnings ($1.80 annualized dividend, $2.84 in EPS), the payout is safe, and has ample room to grow, particularly as earnings continue to grow.

Starbucks is a very complete stock, offering a competitive advantage and moat, a strong history of operational excellence, a reasonable valuation, and ample dividend growth potential.