Summary

- Nike’s digital initiatives are driving revenue and lowering costs.

- Greater China provides potential for long-term sales gains.

- There is a great deal of evidence indicating NKE holds the position as the most popular apparel brand.

With iconic brands like Air Jordan and Air Max, Nike Inc. (NKE) is the undisputed leader in footwear and sports apparel. The company’s $37 billion in FY 2020 sales attest to its dominance, but that number only hints at the true story.

The management team’s adept handling of coronavirus-related issues did more than minimize the damage: Nike turned the closures and restrictions to its advantage.

Over each of the last three quarters, the firm recorded roughly 80% year-over-year digital growth. Nike’s North American segment experienced 100% digital growth, with digital now representing 25% of the business in that region.

Increased sales are not new for Nike. In 2011, the company held 16.8% of the global market in footwear. By 2019, the company’s share had grown to roughly 27%.

The key to the firm’s growth lies in a visionary approach to consumers’ digital experience. This is exemplified by Nike’s membership programs, and other initiatives.

Nike’s Digital Initiatives Should Drive Future Growth

Nike’s Q2 2021 sales were nearly 9% (roughly $1 billion) higher than the comparable quarter in 2020. It is easy to understand the growth e-commerce sales during a period marked by store closures and other restrictions. However, how does one explain the continued increase in digital sales after 90% of Nike’s stores were reopened?

How did the company weather the storm that toppled many other apparel companies? The answer is in Nike’s third party e-commerce efforts.

In 2017, the company launched the Consumer Direct initiative. The goal was to “drive growth by deeply serving customers” in 12 key major metropolitan areas around the globe. Management expected the strategy to drive 80% of the firm’s projected growth through 2020.

Other objectives were to cut production times in half, reduce the number of styles offered while increasing production of products in high demand, cut the global workforce, and enhance and expand the company’s direct-to-consumer retail offerings and membership experiences.

While management largely achieved its aims, the direct-to-consumer/membership efforts are responsible for Nike’s current success.

Digital is now woven into everything we do as a company. It’s how we operate and prioritize, from how we engage with members, to how we operate our supply chain, to how we serve consumers in the marketplace.

Success in e-commerce sales can be attributed in part to the expansion of its membership programs. Since the COVID crisis dawned, 70 million new members have been added to its rolls. To engage those potential customers, Nike held its first Member Days promotion last November. The event reached over 60 million people in 25 countries. Offering rewards for active customers and providing exclusive deals, it is credited for driving higher engagement and conversion metrics.

Nike also offers a free fitness training app (Nike Training Club), providing over 100 class-style workouts, plus nutrition and wellness information. After management decided to make the app free, it experienced a 100% increase in weekly active users.

The firm has an app for runners, Nike+ Run Club. The app dispenses training advice, “guidance, inspiration, and innovation.” According to the CEO, Nike recorded four consecutive months during the pandemic when the app hit a million plus downloads.

Most running sites recommend replacing shoes after 300 to 500 miles. For an athlete running 20 miles per week, that equates to new shoes every four to six months. Consequently, it is easy to see the Run Club app as a useful tool to drive sales of a company known for its footwear.

The SNKRS app is another weapon in Nike’s digital arsenal. The SNKRS app serves as an advertising campaign and portal for users to reserve new products and schedule in store purchases and pickups, all in one. A recent live-streaming event with SNKRS resulted in the company’s Air Jordan PSG selling out of stock in two minutes.

The above are examples, albeit not comprehensive, of the company’s digital initiatives.

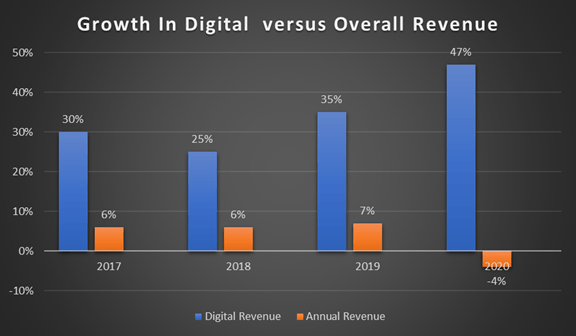

The following chart illustrates how digital is driving Nike’s revenue growth.

Source: Data from company filings / chart by author

Keep in mind that digital revenue reached $5.5 billion in FY 2020, and constituted nearly 15% of total sales. Furthermore, gross margins on digital revenue are 10% higher than with wholesale.

Nike is also utilizing radio-frequency identification (RFID) to track products through the supply chain. In 2019, Nike placed RFID in nearly all of its footwear and apparel products. Management described the technology as “the most precise tool in our arsenal to meet an individual consumer specific need at the exact right moment.”

RFID, coupled with predictive analytics technology gained through its acquisitions of Celect and Zodiac, provide the tools needed to anticipate consumer preferences and demand. This not only increases sales but also lowers costs.

The digital initiatives are driving profits on every front: greater consumer engagement, faster development times, and lower costs of production.

Greater China Growth Prospects

In the latest quarter, Nike’s sales in China increased by 21% to $2.3 billion. This stands in sharp contrast to the paltry 1% sales increase in North America. The big bump in sales in Q2 2021 marked the 22nd consecutive quarterly double-digit increase for the company in China.

Nike edges out Adidas (OTCQX:ADDYY) to lead China’s sportswear market with a 23% market share (20% for Adidas).

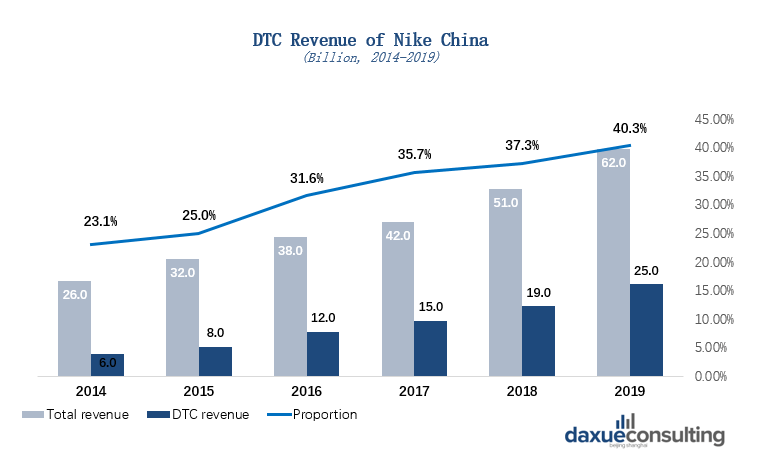

The following chart illustrates the robust growth Nike experienced in the Greater China market as well as the revenue generated by the company’s digital initiatives.

Source: dauxeconsulting

The North American market is a stable but slow growing source of revenue for Nike; however, China surpassed the US as the world’s largest retail market in 2019. Furthermore, in that same year, the percentage of e-commerce sales in China were more than triple that of the US. 2019 also witnessed China’s share of the globe’s online retail sales at well over 55%.

According to a report by McKinsey & Company, 4% of Chinese households were classified as middle class in 2000. By 2012, that percentage had risen to 68%. The country’s urban household income is projected to double from 2013 through 2022.

Source: McKinsey & Company

The growth in China’s middle class, coupled with the populace’s propensity to prefer e-commerce, plays well into Nike’s growth strategy.

How The Younger Generation Will Drive Growth

A recent Piper Sandler’s survey revealed American teens view Nike as the most desired clothing brand. Among teenagers, 27% favored Nike versus the second-place American Eagle (AEO) brand at 8%.

In footwear, Nike was preferred by 52% of teens. Kids also scored NKE as the third-most-popular website.

A survey by BTIG determined Nike is the preferred apparel brand by a wide margin among all age cohorts and genders.

Not only did respondents buy more NKE gear last year, more respondents plan to purchase NKE over the coming months vs. other brands. Regarding future purchase intent, 36% of respondents plan to buy NKE apparel over the next 6 months…

All of this points to a bright future for Nike and its shareholders.

Nike Stock Dividend, Debt, And Valuation

The current yield is .80%, the payout ratio is approximately 37%, and the five-year dividend growth rate is 11.63%.

The firm’s long-term debt at the end of Q2 was $9.41 billion. Cash and equivalents were $11.8 billion. Therefore, Nike has a strong financial position.

As I type these words, the shares trade for $136.38. The 12-month price target of the 33 analysts covering Nike stock is $156.85. The 21 analysts providing a price following the last quarterly report have a target of $163.85.

The current PE is 78.46, the forward PE is 35.42, and the PEG is 2.29.

Is Nike A Good Stock To Buy?

Management transformed Nike into a company powered by digital offerings. Consumers clearly favor the brand by a wide margin, thereby driving sales, and Greater China offers a long growth runway.

It is reasonable to believe the easing of pandemic restrictions will result in a surge due to pent-up demand. Furthermore, the upcoming Summer Olympics will likely contribute to spending on athletic wear.

Nike’s increasing digital and direct sales will increase margins, while the company’s investment in predictive analytics technology gives it an edge in predicting and reacting to consumer demands.

Analysts forecast revenue growth of 15% in fiscal 2021, with EPS recovering to $3.02.

All of this points to a premier investment; however, I see a reason to pause.

I always seek a margin of safety in an investment. Despite the positives I see in NKE, I must rate it as a Hold due to current valuation.