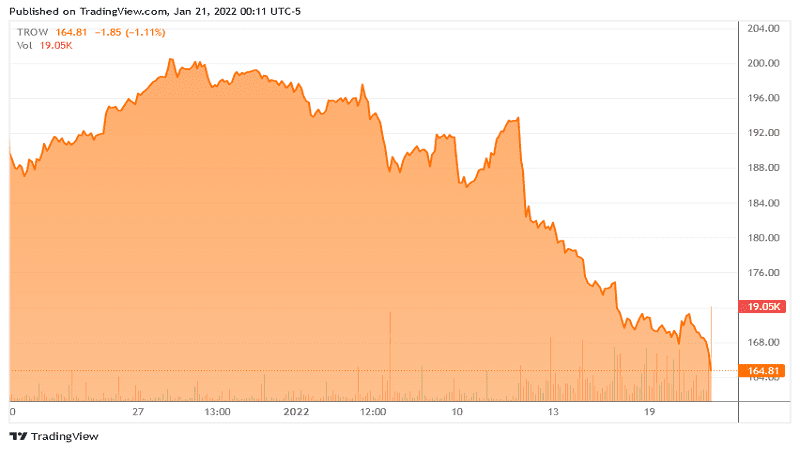

Summary

- T. Rowe Price Group boasts a strong history of earnings and dividend growth that has outperformed the S&P 500 over extended time periods.

- Assets under management continue to climb as mutual fund offerings outperform peers. Retirement accounts and Target Date Fund assets are growing at a strong pace.

- With growing revenue and improving margins, TROW appears undisturbed by disruptive forces in the asset management space.

- A resurgence of actively managed funds and growth in alternative assets will provide a tailwind for TROW revenues.

- T. Rowe Price is undervalued. Current valuations and growth prospects make TROW a solid addition to any portfolio for growth or income.

Editor’s note: Seeking Alpha is proud to welcome ValueVole as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

RiverNorthPhotography/iStock Unreleased via Getty Images

T. Rowe Price Group (TROW) is a dividend monster. With assets under management continuing to grow, the future for T. Rowe Price remains bright.

Mutual fund performance remains strong with superior results relative to peers. Additionally, as broader domestic equity and bond indexes stagnate, investors may abandon passively managed index funds and increasingly seek active management through highly regarded firms such as T. Rowe Price.

In addition, the recent acquisition of Oak Hill Advisors broadens the company’s active management offerings and makes inroads into the Alternative Assets space. Opportunities in this realm will likely appeal to investors seeking diversification from standard equity and bond funds, as well as prospects of elevated compound annual growth rates.

Currently undervalued, continued growth of earnings, free cash flow, and dividends promises to reward patient shareholders with strong long-term investment returns.