Summary

- Chipotle missed Q4 EPS estimates as digital sales soared to 49% of total sales.

- The restaurant saw 25% of total sales from delivery with 13% price hikes that are unlikely to repeat this year.

- The stock trades at an insane 70x ’21 EPS estimates while the business faces headwinds in 2H as digital sales slow down.

- Looking for a portfolio of ideas like this one? Members of Out Fox The Street get exclusive access to our model portfolio. Get started today »

No restaurant chain probably benefitted more from COVID-19 lockdowns than Chipotle Mexican Grill (NYSE:CMG). The company had already leaned into digital sales prior to the shutdowns and only escalated those endeavors in 2020, but now these sales are headwinds in 2H of 2021. My investment thesis warns investors to take profits at these elevated levels.

Image Source: Chipotle website

Digital Sales Headwinds

During the pandemic, restaurants offering online sales and delivery services grabbed market share. Chipotle shined in this area heading into 2020 and further thrived during the shutdowns while other restaurant competition struggled.

In 2021, as the vaccines allow indoor dining to fully reopen in most areas, companies with high digital sales will face headwinds. For Q4, Chipotle grew digital sales by 177.2% to 49.0% of total sales. The company generated $2.8 billion in digital sales for the year, but seen another way, Chipotle only had non-digital sales of $3.2 billion.

People sitting at home ordering delivery last year aren’t as likely to repeat those orders this year. The company has up to $2.8 billion in annual sales at risk this year with the growth from 2019 sales most at risk.

In the prior Q4, Chipotle generated only $282 million in digital sales and saw those sales surge to $781 million last quarter. The delta of $500 million in sales could be at risk as the year progresses, especially considering half of the digital sales were via delivery.

Delivery is where the story is murky come mid-2021. Per CFO Jack Hartung on the Q4 earnings call:

Delivery expenses were elevated year-over-year given the significant growth in delivery with delivery sales now nearly 25% of total sales. To help improve the economics on this premium access point, we have implemented several delivery menu price differentials with a weighted average being right around 13%. We have seen modest resistance thus far and we’ll continue to monitor and adjust pricing as appropriate at the market level or at the restaurant level.

The company obtained $80,000 per store in 2020 from additional sales due to these price hikes on delivery. A lot of these sales will be at risk as dining returns to normal and consumers aren’t as willing to absorb higher prices for delivery.

Huge Price For 10% Growth

Despite running great operations, Chipotle doesn’t generate the profits associated with a stock trading at $1,500. Investors are now paying nearly 70x 2021 EPS estimates for a company with a long-term revenue growth rate in the 10% range.

The restaurant chain will generate some upside growth in the next 2 quarters as the COVID-19 shutdown in March and April limited sales in most regions. The company saw Q2 comps dip 9.8% last year providing the last tailwinds from the virus. By Q3, Chipotle will return to a 10% revenue grower.

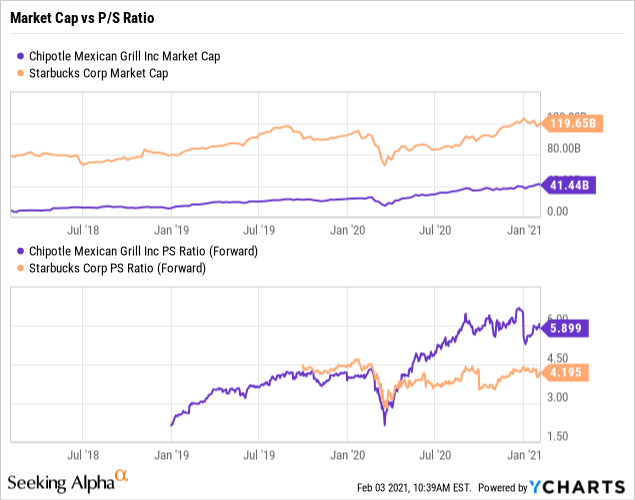

The stock trades in excess of the multiples prescribed to Starbucks (SBUX). The coffee concept now trades at a vast discount to the P/S multiple of Chipotle. Even the much larger Starbucks trades at an excessive valuation for a company with a long-term revenue growth rate below 10%.

Data by YCharts

Data by YCharts

In essence, Chipotle trades at an elevated multiple in comparison to an industry leader. While even Starbucks could face a valuation correction leaving Chipotle at an insane valuation up here.

Analysts are very bullish on the stock with price targets of $1,600 and above. My view is that analysts are extrapolating the January comps too far into the future when indoor dining reopens as last month benefitted even more from elevated digital sales due to high COVID-19 numbers.

Takeaway

The key investor takeaway is that Chipotle is now priced for beyond perfection, yet the bullish sentiment could push the stock to new highs in the near term. As the calendar heads into 2H, the restaurant concept will face meaningful headwinds in the digital sales area leading to the business and the stock underperforming. Investors should use in further rallies to unload Chipotle as the glory days for the last few years are over.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to double and triple in the next few years without taking on the risk of over priced tech stocks.