Summary

- Chipotle released its Q2 results in July, reporting another blowout quarter with high double-digit same-restaurant comps and unit growth revised to 200+ restaurants in FY2021.

- Notably, the company also shared that it is confident it can get to $3 million in average unit volumes, driving further margin expansion, with margin expansion already at new multi-year highs.

- On the labor front, Chipotle did significant hiring at its recent event, with the company noting that its labor situation has improved significantly.

- However, at ~8x sales and with the stock becoming extended short-term, I don’t see any way to justify new purchases here, with the current valuation offering no margin of safety.

- Based on this, I would view rallies above $1,970 before October as an opportunity to book more profits.

It’s been a solid year thus far for restaurant stocks, but one of the most impressive names in the sector generating the most alpha has continued to be Chipotle (CMG). After a blowout Q2 report, Chipotle is now up over 39% year-to-date, with the company bid up yet again on high double-digit same-store comps and a new multi-year high in restaurant-level margins. While the recent minimum wage hike could weigh on margins a little in Q3, the company believes its labor situation has improved considerably, reducing execution risk in H2. However, at 8x sales, there’s no margin of safety at current levels. Therefore, I see no way to justify chasing the stock here above $1,930.

Chipotle released its Q2 results last month and reported revenue of ~$1.89 billion, translating to 39% growth year-over-year. This strong performance was driven by moderate unit growth and incredible same-store comps of 31.2%, with comps expected to remain at low to mid-double-digit levels in Q3. Most impressively, the company noted that restaurant-level margins increased 360 basis points on a two-year basis (Q2 2019: 20.9%) to their best reading in over 5 years. With the company’s confidence that it can push average unit volumes to ~$3 million, there’s further room for expansion for margins, setting up the company for significant earnings growth ahead. Let’s take a closer look at the quarter below:

Chipotle had another incredible quarter in Q2 with revenue of $1.89 billion which beat estimates by over $10 million, and quarterly earnings per share of $7.46, a beat of more than 12%. As noted, the outstanding quarter was mostly attributed to strong same-store comps, translating to a two-year stacked comp growth rate of 21.4%. While same-store comps are expected to reel in a little in Q3 based on its guidance of low to mid-double-digit growth in Q3, but this would still translate to 20% plus comps on a two-year stacked basis. Besides, Chipotle continues to fire on all cylinders, growing its member base at a compound annual growth rate of more than 100% since Q2 2019, retaining ~80% of digital sales, and continuing with its rapid unit growth, raising its previous guidance of 200 restaurants to “200 plus”.

(Source: Company Video, Youtube.com)

On the innovation side, Chipotle announced the launch of its own spicy vegan Chorizo for a limited time at 103 test locations in Indianapolis, IN, Denver, Colorado, and Orange Country, California. This new offering is made with pea protein, water, olive oil, and spices, and is the company’s own proprietary vegan-certified concoction. The Plant-Based Chorizo is high in protein at 20 grams per serving and will give vegans or simply those looking for healthier options another menu item to try. This adds to the other vegan option, Sofritas, and the recently added new health-conscious offering: Cilantro Lime Cauliflower Rice. Let’s take a look at unit growth:

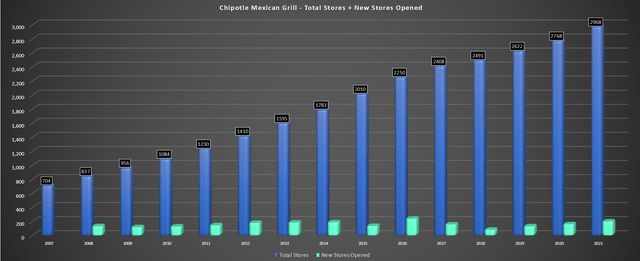

(Source: Company Filings, Author’s Chart)

During the quarter, Chipotle opened 56 new restaurants, with 45 of these being Chipotlanes. Notably, Chipotlanes are massively outperforming non-Chipotlanes opened in the same period, with 20% higher sales. This outperformance is not just recent, but extends to the 88 Chipotlanes open for more than a year vs. restaurants without Chipotlanes in the same period. Given the solid pace of development, Chipotle now expects to be at or above its guidance of 200 new units in FY2021, which would leave Chipotle with over 2,965 restaurants at year-end. This would translate to roughly ~8% unit growth, which is very impressive for a company of Chipotle’s size. Ultimately, Chipotle believes it can double its store count long-term to 6,000 restaurants.

Moving over to digital, the company had a solid quarter, with digital sales up 11% year-over-year to $916 million, which represented just over 48% of total sales. This is a massive improvement on a two-year basis, up over 3000 basis points from 18.2% digital sales in Q2 2019. Chipotle believes that while COVID-19 has certainly helped with the digital growth, investments in technology have also helped to migrate so many members to its platform. This includes adding the chatbot, Pepper, to its platform, which helps to take care of easier tasks to free up customer care team’s time so that they can be available to help with more complicated situations.

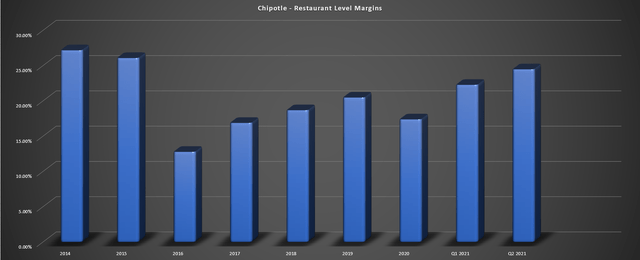

(Source: Company Filings, Author’s Chart)

Given that the digital pick-up order is Chipotle’s highest-margin transaction, the accelerated roll-out of Chipotlanes and ~80% retention of digital sales as dine-in has increased is great news for the company’s margins. As of quarter-end, Chipotle now has more than 23 million members in its loyalty program, up from ~5 million members two years ago. This represents a compound annual growth rate of more than 114%, which is nothing short of incredible. With strong digital sales, and lower food & beverage costs as a percentage of sales in the quarter helped by lower beef prices & menu price hikes, restaurant levels margins came in at an incredible 24.5%. This translated to a 220 basis point improvement from Q2 2021, and the best quarter for margins in over five years.

Finally, on labor, Chipotle noted that labor costs as a percentage of sales were down 370 basis points year-over-year thanks to sales leverage and efficiencies. The 24.5% figure was a 120 basis point improvement on a two-year basis (Q2 2019: 25.7%). However, Chipotle did guide for higher labor costs in Q3 to account for a full quarter of wage increases to the $15.00 level, which was announced in May. On the positive side, the company’s Coast to Coast Career Day event in mid-July resulted in thousands of new hires. Chipotle noted that these new hires have improved the company’s labor position, both for current demand and future growth. Let’s take a look at the company’s earnings trend:

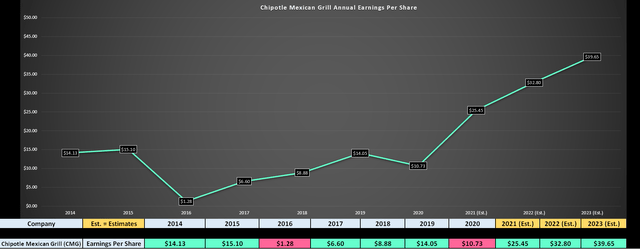

(Source: YCharts.com, Author’s Chart)

As shown above, FY2020 was a rough year for Chipotle, with annual EPS dipping more than 30% to $10.73 due to margin pressures related to the global pandemic. However, it is clear that last year was merely an aberration in a long-term uptrend for earnings, with FY2021 earnings estimates currently sitting at $25.45, translating to ~80% growth on a two-year basis. Looking ahead to FY2022, annual EPS is now forecasted to hit $32.80, with Chipotle expected to maintain a high double-digit annual EPS growth rate. With a forecasted compound annual EPS growth rate of ~11.1% based on FY2022 estimates and ~12.2% based on FY2023 estimates ($39.65), Chipotle continues to be one of the best growth stories in the restaurant space.

Having said, while Chipotle was growing at an attractive price for most of last year, this value proposition has changed considerably since. This is because Chipotle is now trading at ~59x FY2022 earnings estimates at a share price of $1,935, and more than 8x sales. This is a very expensive valuation, even for an industry leader, suggesting that investors looking to start a position are not getting any margin of safety on new purchases. This is corroborated by the stock’s revenue multiple, which is currently sitting above 8 on a price to sales ratio, and near 7 on an enterprise value to forward sales ratio.

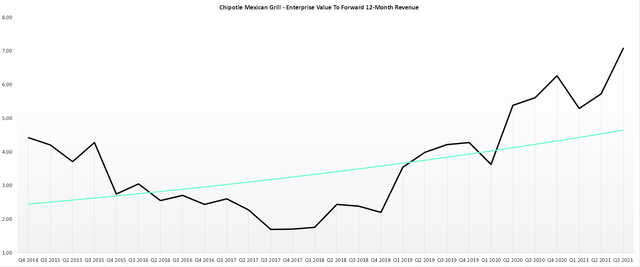

(Source: YCharts.com, Author’s Chart)

As shown in the chart above, Chipotle is now trading above 7x enterprise value to forward sales and well above its trend line for valuation looking back to 2014. In the past, dips below this trendline have provided excellent buying opportunities, with the most recent pullback below this trendline occurring in Q1 2020. However, Chipotle is currently quite extended above this trend line and is also trading well above an area where it’s previously had trouble, at above 5.8x sales (Q1 2014 and Q3 2014). One could argue that Chipotle should trade at a premium given that margins have room to expand to closer to 28.0% if AUVS can get to $3 million. However, even giving Chipotle credit for a 10% premium to historical peak price to sales ratios (6.38), Chipotle still looks priced for near perfection here.

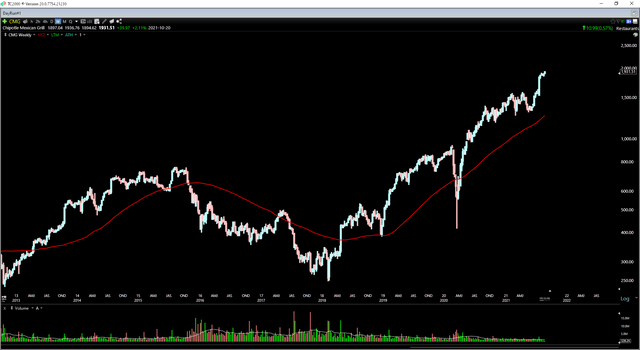

If we look at the technical picture, we can see that Chipotle is now more than 55% above its 85-week moving average (red line), and the reward/risk has generally not been great from these levels. In the past four instances, the average forward 9-month return has been below 9%, while the average forward 9-month drawdown has come in at 18%. This translates to a 1/2 reward to risk ratio on an intra-day drawdown relative to closing price return basis. So, while the returns haven’t been bad by any means on a forward 9-month basis with 3/4 posting positive returns with an average of 8% or higher, the easy money looks to have been made here. With increased risk of a correction, chasing the stock here above $1,930. makes little sense. In fact, I would view a rally above $1,990 before October as an opportunity to book some profits.

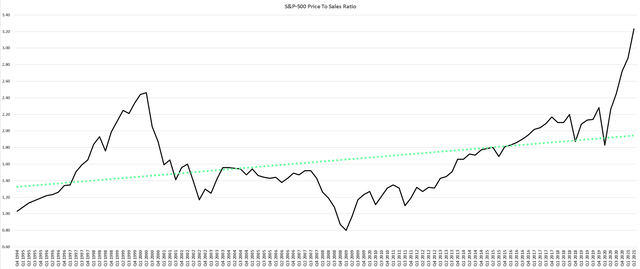

(Source: Multpl.com, Author’s Chart)

Chipotle had another blowout quarter in Q2, and the company is undoubtedly a top-5 name to keep on one’s shopping list if we do get a general market correction. However, with the S&P-500’s (SPY) price to sales ratio in nosebleed territory, and Chipotle extended short-term on a technical basis, I don’t see any way to justify chasing the stock at current levels. Instead, I think investors should be open-minded to rebalancing positions if we do see a rally to the $2,000 level before October. So, while I believe Chipotle is an incredible growth story with a long runway, I remain neutral at current levels and would move to bearish if the stock heads above $2,070 before October.