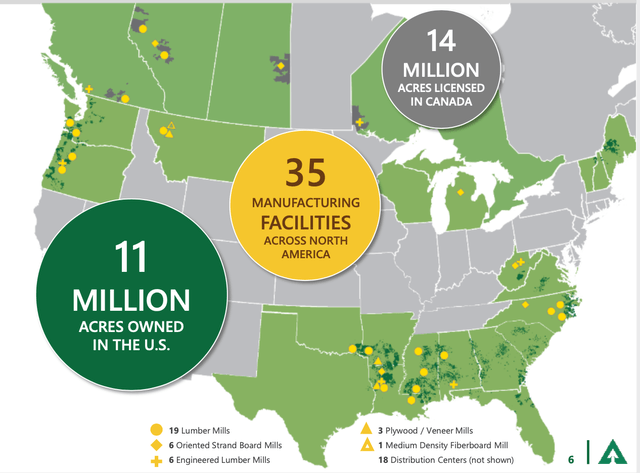

- Weyerhaeuser is the largest timber REIT and a significant steward of North American timberlands.

- Weyerhaeuser should significantly benefit from the increased lumber pricing and continued strong demand for new housing.

- Weyerhaeuser is again paying a dividend, after stopping to pay in the spring, and has the potential to increase it in 2021.

Weyerhaeuser (NYSE:WY) appears undervalued. In May, Weyerhaeuser suspended its dividend and slashed costs in preparation for the unknown. Since then, strong new housing demand fueled the need for housing materials. While expectations for the resumption of Weyerhaeuser’s dividend this summer were early, the company did eventually announce the reinstatement of distributions along with Q3 reporting at the end of October. There also appears the strong possibility for the company to report supplemental dividends and an increase to its new base dividend within 2021.

Weyerhaeuser is the largest timber REIT and largest private owner of North American timberlands.

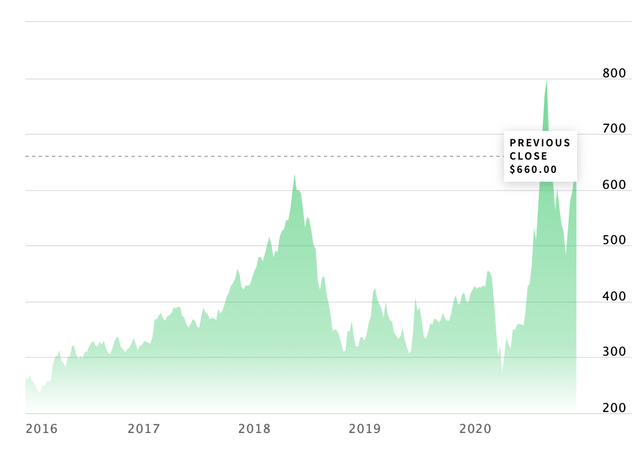

Pandemic related effects caused companies like Weyerhaeuser to initially reduce their capacity but will now go full throttle. The capacity constraints caused lumber prices to spike, and the return of capacity contributed to the reduction of the initial price spike, where lumber peaked in late August. Lumber prices appeared to reach a near-term bottom in late October, when the broader markets also made a near-term bottom. This is also just before Weyerhaeuser reinstated the dividend.

(Source: Nasdaq YTD lumber futures chart)

Though lumber prices are well below their recent high, lumber is still selling at better prices than pretty much any other time in recent history. It could very well be the case that lumber has been repriced for the near term and that $500 will be support until this current wave of demand subsides.

Given the strong lumber demand and pricing, it is likely that Weyerhaeuser will continue to ramp its capacity and keep it as fully utilized as possible within 2021. With lumber futures effectively fetching around double the prior year’s average price, there is good reason to believe the company should have the capacity to return a considerable amount of cash to shareholders next year. This is likely to take the form of a special dividend and share repurchasing, and possibly an increase to the base dividend.